Form 1746 Draft - Missouri Sales/use Tax Exemption Application 2010 Page 3

ADVERTISEMENT

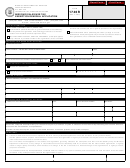

FORM 1746

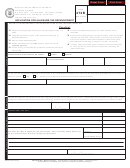

INSTRUCTIONS FOR COMPLETING THE MISSOURI SALES/USE TAX EXEMPTION APPLICATION

Missouri Tax I.D. Number

If you have been issued a Missouri Tax I.D. Number by the Missouri Department of Revenue, enter that number in the space

provided. Providing your Missouri Tax I.D. Number will ensure the Department of Revenue registers your organization accurately.

Organization Name and Location

Provide the name and street address of your organization.

Incorporated Organizations

If you are incorporated in Missouri, check “Missouri Corporation” and provide the required information.

If you are an out-of-state corporation, and own property in Missouri, check the “Out-of-State Corporation” box and provide the

required information.

Mailing Address

If correspondence should be mailed to an address other than the address of the organization or agency, provide the address to be

used for mailing purposes (i.e., officer’s, accountant’s, or lawyer’s address, etc.) P.O. Box may be used.

Record Storage

If the books and records are kept at an address (location) other than that of the organization, agency, or mailing address, provide

the address here.

Organization or Agency Officers

Provide all of the requested information for one or two of the organization’s or agency’s officers.

Description of Organization

Summarize the primary organizational purpose in one or two brief statements. List the main activities of the organization or

agency.

Signature

This application must be signed by an officer or responsible person of the organization in order for the exemption letter to be

issued.

Attachments

The attachments are used to determine whether an organization is exempt under Missouri law. Please remember to include all

attachments pertaining to your organization. If you do not include all required attachments, it could result in a delay in issuing your

exemption letter or a denial of your application.

IRS EXEMPTION RULING

If you are registered with the Internal Revenue Service (IRS) and have received a 501c letter, you must attach a copy of the most

current letter of exemption issued to you by the IRS.

If you have not received an exemption letter from the IRS, you can obtain Form 1023, Application for Recognition of Exemption by

visiting their web site at or call (877) 829-5500.

MO 860-2158 (11-2010)

DOR-1746 (11-2010)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3