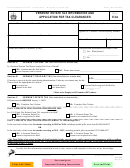

Homeowner Tax Benefits INITIAL APPLICATION — 2018/19

2. OWNER(S) INFORMATION

• For a life estate, provide owner info for life estate holder and spouse.

• For a trust, provide owner information for qualifying beneficiary/trustee and submit copy of entire Trust Agreement.

• If the property is a cooperative, please provide a copy of the stock certificate.

• If an owner is deceased, do not include info below. Submit copy of death certificate.

• For divorced, legally separated, or abandoned owners, do not include info for absent owner. Submit copy of court

documents.

• If the property was willed to an owner, please submit a copy of last will and testament, probate or court order.

• For owner receiving medical care in a health care facility, submit documentation from health care facility.

Owner 1:

NAME (FIRST, LAST)

DATE OF BIRTH (mm/dd/yyyy)

SOCIAL SECURITY / ITIN NUMBER

STREET ADDRESS

APT.

CITY

STATE

ZIP

TELEPHONE

CELL PHONE

(

)

–

(

)

–

NUMBER

NUMBER

n

n

EMAIL ADDRESS

IS THIS THE PRIMARY RESIDENCE OF OWNER 1?

Yes

No

Owner 2:

NAME (FIRST, LAST)

DATE OF BIRTH (mm/dd/yyyy)

SOCIAL SECURITY / ITIN NUMBER

STREET ADDRESS

APT.

CITY

STATE

ZIP

TELEPHONE

CELL PHONE

(

)

–

(

)

–

NUMBER

NUMBER

n

n

EMAIL ADDRESS

IS THIS THE PRIMARY RESIDENCE OF OWNER 2?

Yes

No

n

n

n

n

ARE OWNERS 1 AND 2

ARE OWNERS 1 AND 2

Yes

No

Yes

No

MARRIED TO EACH OTHER?

SIBLINGS (BROTHERS / SISTERS?)

If there are more than two owners, please complete the Additional Owners section on page 5

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether

compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for

applicants and income-earning occupants is mandatory and is required by section 11-102.1 of the Administrative Code of the City of New York. Such numbers disclosed on

any reports or returns are requested for tax administration purposes and will be used to facilitate the processing of reports and to establish and maintain a uniform system for identifying

taxpayers who are or may be subject to taxes administered and collected by the Department of Finance. Such numbers may also be disclosed as part of information contained

in the taxpayer’s return to another department, person, agency or entity as may be required by law, or if the applicant or income-earning occupants give written authorization to

the Department of Finance.

2

HB-01 Rev. 01.10.17

1

1 2

2 3

3 4

4 5

5