Essential Information For St-3ez Page 3

ADVERTISEMENT

STEP-BY-STEP INSTRUCTIONS FOR ST-3EZ

Please read this section before completing your form.

If you have a retail license or use tax registration, you are required to file a tax return even

if there is NO TAX DUE for the period. To file your zero gross sales return by phone call

1-803-898-5918.

WHEN FILING "NO SALES" RETURNS, please enter zeroes on lines 1 and 3 only on the ST-3EZ.

COMPLETE THE SALES AND USE TAX WORKSHEET ON THE FRONT OF THE ST-3EZ BEFORE MAKING ENTRIES

ON LINES 1 THROUGH 8.

IMPORTANT: If it is determined that no entry is needed on a line (other than lines 1 and 3), PLEASE LEAVE LINE BLANK.

Do not write on the lines that do not pertain to you.

All entries must be typed or hand printed. If using a non-preprinted form, see the introduction section under Essential

Information for instructions.

STEP 1

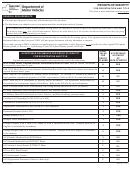

COMPLETING THE SALES AND USE TAX WORKSHEET

PART II

74,000.00

1. Gross Proceeds of Sales/Rentals, Withdrawals of Inventory for Own Use

1.

3,000.00

2. Out-of-State Purchases Subject to Use Tax

2.

77,000.00

3. Total (Add lines 1 and 2. Enter here and on line 1 of Part I.)

3.

4. Sales and Use Tax Allowable Deductions (Itemize by Type of Deduction and Amount of Deduction)

Column A

Column B

Type of Deduction

Amount of Deduction

1,000.00

$

Sales Exempt During "Sales Tax Holiday"

30,000.00

Sales for Resale

$

SAMPLE

9,000.00

Sales to Federal Government

$

<

>

40,000.00

5.

5.Total Amount of Deductions (Total Column B, enter here and on line 2, Part I)

SALES AND USE TAX WORKSHEET INSTRUCTIONS

LINES 1 through 5

Line 1: Gross Proceeds of Sales/Rentals, Withdrawals of Inventory for Own Use

Enter the total amount of all sales (taxable and nontaxable), leases and/or rentals of tangible personal property made by

the business for the reporting period. Nontaxable sales are itemized on line 4 and deducted on line 5. DO NOT INCLUDE

THE AMOUNT OF SALES TAX COLLECTED.

You must also report purchases of tangible personal property (merchandise, equipment, etc.) purchased tax free at

wholesale, but used by you and/or your employees. When purchasing merchandise out-of-state, there may be

circumstances when additional tax is due. To determine if you owe additional tax, contact the South Carolina Department

of Revenue. (803) 898-5788

Line 2: Out-of-State Purchases Subject to Use Tax

Enter the total purchases of tangible personal property purchased from an out-of-state retailer who did not collect South

Carolina use tax. If the tax rate in your county is greater than the tax rate paid out-of-state, contact SCDOR for additional

information.

Line 3: Total

Add lines 1 and 2. Enter total here and on Line 1, of Part I on ST-3EZ.

Line 4: Sales and Use Allowable Deductions

To claim a deduction relating to a sale, the sales transaction must be reported on line 1 or 2 of this worksheet. Enter the

type of deduction (see list on next page) in Column A and the dollar amount of the sale in Column B. South Carolina law

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5