Essential Information For St-3ez Page 5

ADVERTISEMENT

The discount amount is $10,000 for out-of-state retailers who cannot be required to register for sales and use tax but who

voluntarily register to collect and remit the tax. However you must receive prior approval from the Department of Revenue

for the $10,000 discount.

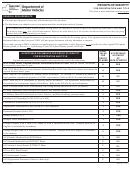

Line 6 Sales and Use Tax Net Amount Payable: Line 4 minus 5.

Line 7 Penalty and Interest: Enter the total of Penalty and Interest, from calculations below or visit our website:

and click on Penalty and Interest Calculator

PENALTY FOR FAILURE TO FILE A RETURN: Five percent (.05) of the amount of tax due (from line 4 on the front of the

return) for each month or fraction of a month of delinquency, not to exceed twenty-five percent (.25) of the amount of tax

due.

PENALTY FOR FAILURE TO PAY TAX DUE: The penalty is one-half of one percent (.005) of the amount of tax due (the

total of line 4 on the front of the return) for each month or fraction of a month of delinquency, not to exceed a total of

twenty-five percent (.25) of the amount of tax due. The penalty for failure to file and pay must be combined and entered as

a total on line 7.

INTEREST: Interest is assessed in accordance with Sections 6621 and 6622 of the Internal Revenue Code. Rates are

based on the prime rate, subject to change quarterly and are compounded daily.

Line 8 Total Sales and Use Tax

Enter the total of lines 6 and 7.

:

STEP 3

ST-3EZ -

SIGNATURE

Sign and date your return on the ST-3EZ.

DON'T FORGET

Returns are past due after the 20th of the month.

If you are not using preprinted forms and it is necessary to use blank forms, be sure to include your social security number

or Federal Employer Identification number in the label section.

REMITTANCE (CHECKS)

Your Name

1. Checks must be made payable to: SC DEPARTMENT OF REVENUE

Your Address

20

Any town, State Zip

2. Verify the dollar and written amount of the check.

SAMPLE

3. Indicate type of tax and retail license number on the check.

$

2

1

Pay to

4. Complete signature must be provided.

Dollars

2

5. Return and check must be mailed in the same envelope.

3

4

FOR

123456789

123456

1234

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to

use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201

mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers,

as prescribed, for securing proper identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of

Revenue is limited to the information necessary for the Department to fulfill its statutory duties. In most instances, once

this information is collected by the Department, it is protected by law from public disclosure. In those situations where

public disclosure is not prohibited, the Family Privacy Protection Act prevents such information from being used by third

parties for commercial solicitation purposes.

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5