Essential Information For St-3ez Page 4

ADVERTISEMENT

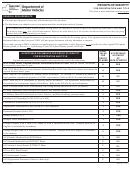

provides for a deduction from gross proceeds of sales those items specifically exempt from tax. The list below is used to

identify some of the items to be shown as a deduction. Any amount claimed as a deduction on your return must be itemized

in Column A and B of this worksheet. You are required to maintain records that will support all deductions claimed on this

return. A further explanation of deductions is available by obtaining a copy of the South Carolina Sales and Use Tax Code

of Laws by contacting the Department's Main Office, the Taxpayer Service Centers or visit our website:

Examples of Allowable Deductions: (Not all inclusive)

Installation charges (separately stated on invoice)

Sales for resale

Trade-ins

Out-of-state sales

Excess over tax cap

Exempt sales to:

Mobile Home (35% of mobile home sales)

Manufactures

Food purchased with food stamps

Agriculture

Sales Tax Holiday exempt sales

Federal Government

1% tax reduction for purchases made by individuals age

85 and older for their own use

Medicine and prosthetic devices (by prescription)

NOTE: This 1% tax reduction does not apply to local tax

Diabetic Supplies (by written authorization)

calculation.

Gasoline sales

Line 5: Total Amount of Deductions (Total Column B and enter on line 2, Part I)

STEP 2

ST-3EZ

-

Calculation of 5% Sales and Use Tax

PART I -

SAMPLE SALES AND USE TAX INSTRUCTIONS

SALES AND USE TAX

1. Gross Proceeds of Sales, Rentals, Use Tax and Withdrawals for Own Use

7 7 0 0 0

0 0

.

1

(From line 3 of Sales and Use Tax Worksheet)

4 0 0 0 0

0 0

.

2. Total Amount of Deductions (From line 5 of Sales and Use Tax Worksheet)

2

3 7 0 0 0

0 0

.

3

3. Net Taxable Sales (Line 1 minus line 2)

5%

1 8 5 0

0 0

.

4

4. Tax (Line 3 x 5% (.05))

5. Taxpayer's Discount (For timely filed returns only) If your tax liability is less

3 7

0 0

.

than $100.00, the discount rate is 3% (.03) of line 4. If the total is $100.00 or

5

more, the discount is 2% (.02) of line 4.

NEW

(Discount cannot exceed $3000.00 per fiscal year, returns for June

through May, which are filed July through June.)

14-3701

1 8 1 3

0 0

.

6. Sales and Use Tax Net Amount Payable (Line 4 minus line 5)

6

14-3702

7. Penalty _________________ , Interest ___________________

.

(Add Sales and Use Tax penalty and interest. Enter total on line 7 at right.)

7

OFFICE USE ONLY: ___________________________

1 8 1 3

0 0

.

8. Total Sales and Use Tax Due (Add lines 6 and 7)

8

IMPORTANT: If it is determined that no entry is needed on a line, PLEASE LEAVE LINE BLANK. Do not write on the lines

that do not pertain to you.

Line 1 Gross Proceeds of Sales: Enter the gross proceeds of sales, rentals, use tax and withdrawals for own use. Enter

the total from Part II, line 3 of your worksheet. Do not include sales tax collected in this amount.

Line 2 Total Amount of Deductions: Enter the total amount of deductions from line 5 of your worksheet.

Line 3 Net Taxable Sales: Subtract line 2 from line 1.

Line 4 Tax (Multiply line 3 x 5% (.05).)

Line 5 Taxpayer's Discount: A taxpayer's discount may be claimed when the return is filed and the tax due is paid in full

on or before the due date of the return. No discount is allowed if the return or payment is received after the due date. The

discount is computed as follows:

If your tax liability (line 4, ST-3EZ) is less than $100.00, the discount rate is 3% (.03) of line 4. If the total is $100.00 or

more, the discount rate is 2% (.02) of line 4. Deduct this amount from line 4.

Note:Discounts are not allowed to exceed $3,000.00 per taxpayer (for all locations) during any one South Carolina fiscal

year, which covers payments made from July 1 through June 30. This includes all returns which become due during this

period (returns for June through May). The $3,000.00 maximum includes the total discounts for sales/use and local taxes.

Taxpayers who file and pay electronically are allowed a $3,100 maximum discount.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5