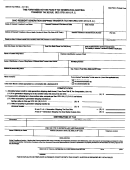

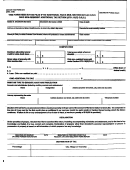

Form 34 - Qualified Farm Property Valuation Election Application (Section 5731.011 O.r.c.) Page 2

ADVERTISEMENT

Estate Tax Form 34

Revised 12/01

Part II – Election

The following information must be provided to the Tax Commissioner before a farm property valuation election

may be made.

1. Description of farm property. Attach a full legal description of the farm property subject to election, and identify by

schedule and item number on the estate tax return the farm property subject to the election. If the farm property is held

by a partnership, corporation or trust, identify such entity. (The interest in a partnership, corporation or trust qualifies

only if farm property would have qualified if decedent owned it directly.)

2. Fair market value. Attach a statement of the fair market value of the farm property, including a copy of the appraisal.

The appraisal must show separate values for the one-acre homesite, the improvements and the land only.

3. Qualified heirs. List the names, relationship to the decedent and addresses of the qualified heirs who have or will

receive the farm property.

Name

Relationship

Address

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

4. Transfer instrument. Attach a copy of the legal document transferring the farm property to the qualified heirs. If not

transferred when estate tax return filed, a copy must be submitted within sixty (60) days of the date of transfer.

5. Agricultural use application. Attach a copy of the most recent real estate tax card(s) showing the agricultural use

value and the appraised value. (Circle agricultural use value on copies.)

c

If no application has been filed, check here

and complete the worksheet titled Estate Tax Form 35 – Worksheet for

Developing the Value of Qualified Farm Property.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4