Form 34 - Qualified Farm Property Valuation Election Application (Section 5731.011 O.r.c.) Page 3

ADVERTISEMENT

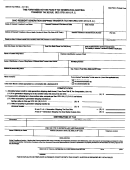

Estate Tax Form 34

Revised 12/01

6. Farm Use Valuation Instructions and Worksheet

Please complete the following to calculate the CAUV amount to be used for the Estate Tax Form 2

(a) Qualified use value (CAUV) for real property land only (use column 3 below) ................................... $ _____________

(b) Market value for real property land only (use column 2 below) .......................................................... $ _____________

(c) (1) Market value of the 1-acre homesite(s) only (use column 4 below) ........... $ _____________

(2) Market value of improvments only (use column 5 below) ........................... $ _____________

(3) Total of (c)(1) plus (c)(2) ............................................................................................................... $ _____________

(d) Total fair market value – sum of (b) and (c)(3) .................................................................................... $ _____________

(e) Qualified use value – sum of (a) and (c)(3)

(Note: this is the CAUV amount that will be reported on Estate Tax Form 2)............................... $ _____________

(f) Qualified use reduction – (d) minus (e), not to exceed the $500,000 recoupment base ....................... $ _____________

(g) Amount over $500,000 plus the qualified use value from above, line (e) ............................................. $ _____________

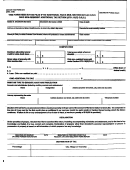

Fill in the columns below as follows:

Column 1 (A) and (B). Insert the parcel number in Column 1(A) and the number of acres in Column 1(B) for each parcel.

Column 2. Insert the appraiser’s opinion of the fair market value of the land only, less the value of the one-acre homesite(s).

The fair market value should be supported with comparable sales.

Column 3. The qualified use value is taken directly off the tax assessment card reduced by the value of the 1-acre

homesite(s). (Most, but not all, qualified use values contain a homesite value.) Do not include the one-acre homesite(s)

value in this column.

Column 4. The site(s) value(s) at the fair market value is/are determined separately by the appraiser(s). (Note: valuation

cannot be less than county auditor’s appraisal.)

Column 5. The improvement valuation(s) at fair market value(s) is/are determined separately by the appraiser(s). (Note:

valuation cannot be less than the county auditor’s appraisal.)

Column 6. Indicate the ownership percentage of the real estate owned by the decedent.

Show full values in all columns. Multiply columns 2, 3, 4 and 5 by the percentage in Column 6 and transfer these figures to

the approrpriate lines above.

General Information

Value of Land minus the

Valuation cannot be less than the

Per Parcel

One-Acre Homesite(s)

county auditor’s appraisal

Column 1(A)

Column 3

Column 4

Column 5

Column 6

Column 1(B)

Column 2

Fair Market

Qualified Use

Site value(s) fair

Improvement Valu-

Parcel

Value

Valuation

Ownership

market value

ation’s Market Value

Number

Acres

Per Parcel

Per Parcel

l

%

Per Parce

Per Parcel

- 3 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4