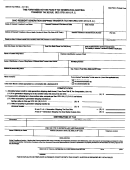

Form 34 - Qualified Farm Property Valuation Election Application (Section 5731.011 O.r.c.) Page 4

ADVERTISEMENT

Estate Tax Form 34

Revised 12/01

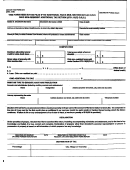

7. Timely filed return. The election is effective only if made on a timely filed estate tax return, with any extensions

granted by the Estate Tax Division.

Estates of decedents with a date of death on or after January 1, 2000 are granted an automatic six-month extension,

allowing them a total of 15 months to file the estate tax return. Any additional six-month extensions must be requested

in writing directly to the Estate Tax Division on ET Form 24 before the due date of the return.

8. Disposition. If an interest in the qualified farm property is disposed of (other than a transfer to another qualified heir)

or the farm property no longer devoted exclusively to agricultural use within four (4) years of decedent’s death and prior

to the qualified heir’s death, then a recapture tax shall be imposed. The recapture tax shall be equal to the tax savings

realized by the decedent’s estate by the farm property valuation election. The tax and interest (calculated from nine

months from decedent’s death) are due within nine (9) months of the disqualifying disposition or cessation of qualified

use. The qualified heir is personally liable for payment of the recapture tax owed. File Estate Tax Form 2X.

9. Annual reports. The qualified heir must file an annual report, Estate Tax Form 36, on the second, third and fourth

anniversary dates of decedent’s death with the Estate Tax Division (800 Freeway Drive North, Columbus, OH 43229)

verifying that the farm property has not been disposed of nor ceased to be devoted exclusively for agricultural use by

the qualified heir.

10. Lien. A tax lien equal to the tax savings realized by the decedent’s estate due to the farm property valuation election

shall remain on the farm property for four years from the decedent’s death or until earlier discharge. The tax lien may

be subordinated by the Tax Commissioner upon written request if the State’s interest remains adequately protected

after the subordination.

11. Inspection. The Tax Commissioner, or duly appointed agent, is entitled to inspect the farm property to verify the

accuracy of the statements in this election.

Attach this completed Estate Tax Form 34 to the back of the Estate Tax Return Form 2.

Date Received by

Part III – Identification

Ohio Department of Taxation

Name of Preparer _____________________________________________________________

Address _____________________________________________________________________

City, State and Zip Code ________________________________________________________

Telephone number of preparer ___________________________________________________

Designation, please circle one:

Attorney

Executor

Administrator(s)

Part IV – Signature and Verification

Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are true and correct.

Signature of Preparer

Date

- 4 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4