Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 19

ADVERTISEMENT

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

Schedule A (Form 990 or 990-EZ) 2015

Page

6

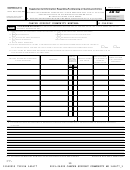

Part V

Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations

1

Check here if the organization satisfied the Integral Part Test as a qualifying trust on Nov. 20, 1970.

See instructions.

All

other Type III non-functionally integrated supporting organizations must complete Sections A through E.

(B) Current Year

Section A - Adjusted Net Income

(A) Prior Year

(optional)

1

Net short-term capital gain

1

2

Recoveries of prior-year distributions

2

3

Other gross income (see instructions)

3

4

Add lines 1 through 3

4

5

Depreciation and depletion

5

6

Portion of operating expenses paid or incurred for production or

collection of gross income or for management, conservation, or

maintenance of property held for production of income (see instructions)

6

Other expenses (see instructions)

7

7

(subtract lines 5, 6 and 7 from line 4)

8

Adjusted Net Income

8

(B) Current Year

Section B - Minimum Asset Amount

(A) Prior Year

(optional)

1

Aggregate fair market value of all non-exempt-use assets (see

instructions for short tax year or assets held for part of year):

a

Average monthly value of securities

1a

b

Average monthly cash balances

1b

c

Fair market value of other non-exempt-use assets

1c

d

Total

(add lines 1a, 1b, and 1c)

1d

e

Discount

claimed for blockage or other

factors (explain in detail in

Part VI

):

2

Acquisition indebtedness applicable to non-exempt-use assets

2

3

Subtract line 2 from line 1d

3

4

Cash deemed held for exempt use. Enter 1-1/2% of line 3 (for greater amount,

see instructions).

4

5

Net value of non-exempt-use assets (subtract line 4 from line 3)

5

6

Multiply line 5 by .035

6

7

Recoveries of prior-year distributions

7

8

Minimum Asset Amount

(add line 7 to line 6)

8

Section C - Distributable Amount

Current Year

1

Adjusted net income for prior year (from Section A, line 8, Column A)

1

2

Enter 85% of line 1

2

3

Minimum asset amount for prior year (from Section B, line 8, Column A)

3

4

Enter greater of line 2 or line 3

4

5

Income tax imposed in prior year

5

6

Distributable Amount.

Subtract line 5 from line 4, unless subject to

emergency temporary reduction (see instructions)

6

7

Check here if the current year is the organization's first as a non-functionally-integrated Type III supporting organization (see

instructions).

Schedule A (Form 990 or 990-EZ) 2015

532026

09-23-15

18

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41