Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 9

ADVERTISEMENT

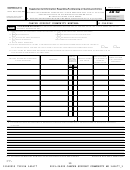

CANCER SUPPORT COMMUNITY MONTANA

81-0542266

8

Page

Form 990 (2015)

Part VII

(continued)

Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees

(B)

(C)

(A)

(D)

(E)

(F)

Position

Average

Name and title

Reportable

Reportable

Estimated

(do not check more than one

hours per

compensation

compensation

amount of

box, unless person is both an

officer and a director/trustee)

week

from

from related

other

(list any

the

organizations

compensation

hours for

organization

(W-2/1099-MISC)

from the

related

(W-2/1099-MISC)

organization

organizations

and related

below

organizations

line)

58,411.

0.

0.

1b

Sub-total

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

0.

0.

0.

c

Total from continuation sheets to Part VII, Section A

~~~~~~~~~~ |

58,411.

0.

0.

d

Total (add lines 1b and 1c)

•••••••••••••••••••••••• |

2

Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable

0

compensation from the organization |

Yes

No

3

Did the organization list any

former

officer, director, or trustee, key employee, or highest compensated employee on

X

If "Yes," complete Schedule J for such individual

line 1a?

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3

4

For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization

X

If "Yes," complete Schedule J for such individual

and related organizations greater than $150,000?

~~~~~~~~~~~~~

4

5

Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services

X

If "Yes," complete Schedule J for such person

rendered to the organization?

••••••••••••••••••••••••

5

Section B. Independent Contractors

1

Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from

the organization. Report compensation for the calendar year ending with or within the organization's tax year.

(A)

(B)

(C)

NONE

Name and business address

Description of services

Compensation

2

Total number of independent contractors (including but not limited to those listed above) who received more than

0

$100,000 of compensation from the organization |

990

Form

(2015)

532008

12-16-15

8

13340919 792194 141677

2015.04020 CANCER SUPPORT COMMUNITY MO 141677_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41