Form 8879-Eo - Irs E-File Signature Authorization For An Exempt Organization Sample - 2015 Page 33

ADVERTISEMENT

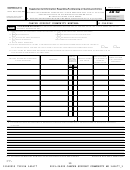

2015 DEPRECIATION AND AMORTIZATION REPORT

FORM 990 PAGE 10

990

*

C

Date

Unadjusted

Bus

Section 179

Reduction In

Basis For

Beginning

Current

Current Year

Ending

Asset

Line

o

Description

Method

Life

No.

Acquired

No.

Cost Or Basis

%

Expense

Basis

Depreciation

Accumulated

Sec 179

Deduction

Accumulated

n

v

Excl

Depreciation

Expense

Depreciation

11 FURNITURE FOR SUPPORT GROUP 04/18/14 200DB 7.00 MQ17

432.

432.

77.

101.

178.

DESKS, CHAIRS, & LAMPS FOR

15

08/03/15 200DB 7.00 HY19C

1,506.

753.

753.

861.

108.

UPSTAIRS

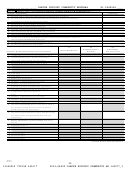

17 ARTWORK FOR KITCHEN

12/22/15 200DB 7.00 HY19C

800.

400.

400.

457.

57.

18 DELL COMPUTER FOR KATELYN

03/12/15 200DB 5.00 HY19B

809.

405.

404.

486.

81.

19 OFFICE FURNITURE FOR REMODEL 09/01/15 200DB 7.00 HY19C

2,285.

1,143.

1,142.

1,306.

163.

21 STATUE FOR GARDEN

07/01/15 150DB 15.00 HY19E

9,500.

4,750.

4,750.

4,988.

238.

* 990 PAGE 10 TOTAL

22,745.

7,451.

15,294.

6,227.

8,560.

7,336.

FURNITURE & FIXTURES

* GRAND TOTAL 990 PAGE 10

921,980.

7,844.

914,136. 113,639.

39,088. 144,883.

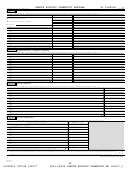

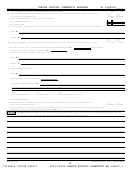

DEPR

CURRENT ACTIVITY

BEGINNING BALANCE

896,257.

0.

896,257. 113,639.

ACQUISITIONS

25,723.

7,844.

17,879.

0.

DISPOSITIONS

0.

0.

0.

0.

ENDING BALANCE

921,980.

7,844.

914,136. 113,639.

ENDING ACCUM DEPR

152,727.

ENDING BOOK VALUE

769,253.

528111

(D) - Asset disposed

* ITC, Salvage, Bonus, Commercial Revitalization Deduction, GO Zone

04-01-15

34.2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41