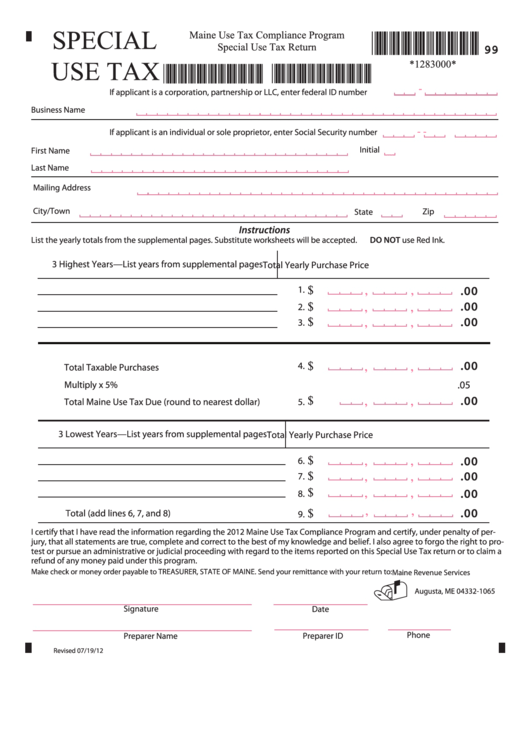

Maine Use Tax Compliance Program Special Use Tax Return

ADVERTISEMENT

SPECIAL

Maine Use Tax Compliance Program

*1283000*

99

Special Use Tax Return

USE TAX

*1283000*

*12012011* *12312011*

-

If applicant is a corporation, partnership or LLC, enter federal ID number

Business Name

-

-

If applicant is an individual or sole proprietor, enter Social Security number

Initial

First Name

Last Name

Mailing Address

City/Town

Zip

State

Instructions

DO NOT use Red Ink.

List the yearly totals from the supplemental pages. Substitute worksheets will be accepted.

3 Highest Years—List years from supplemental pages

Total Yearly Purchase Price

$

1.

.00

,

,

$

.00

,

,

2.

$

.00

,

,

3.

$

.00

4.

,

,

Total Taxable Purchases

Multiply x 5%

.05

$

.00

,

,

Total Maine Use Tax Due (round to nearest dollar)

5.

3 Lowest Years—List years from supplemental pages

Total Yearly Purchase Price

$

.00

,

,

6.

$

.00

,

,

7.

$

.00

,

,

8.

,

,

$

.00

Total (add lines 6, 7, and 8)

9.

I certify that I have read the information regarding the 2012 Maine Use Tax Compliance Program and certify, under penalty of per-

jury, that all statements are true, complete and correct to the best of my knowledge and belief. I also agree to forgo the right to pro-

test or pursue an administrative or judicial proceeding with regard to the items reported on this Special Use Tax return or to claim a

refund of any money paid under this program.

Make check or money order payable to TREASURER, STATE OF MAINE. Send your remittance with your return to:

Maine Revenue Services

P.O. Box 1065

Augusta, ME 04332-1065

Signature

Date

Phone

Preparer Name

Preparer ID

Revised 07/19/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4