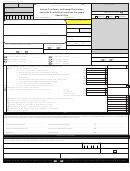

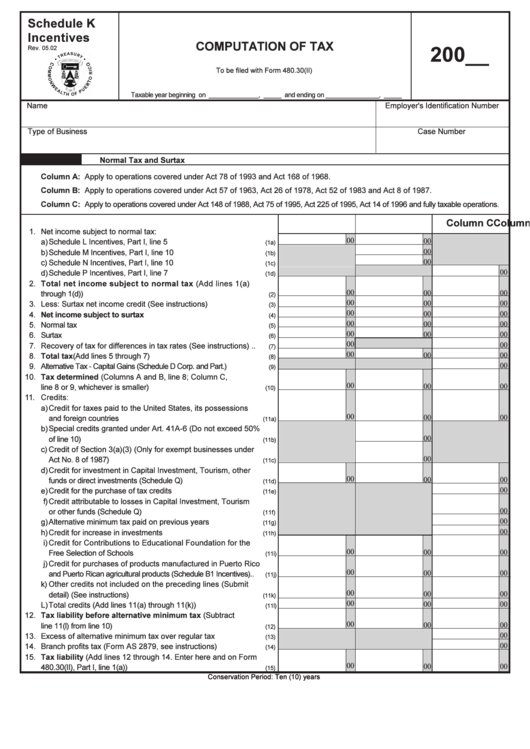

Schedule K Incentives - Attachment To The Form 480.30(Ii) - Computation Of Tax - 2002

ADVERTISEMENT

Schedule K

Incentives

COMPUTATION OF TAX

200__

Rev. 05.02

To be filed with Form 480.30(II)

Taxable year beginning on ______________, _____ and ending on _______________, _____

Name

Employer's Identification Number

Type of Business

Case Number

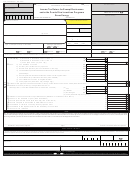

Part I

Normal Tax and Surtax

Column A:

Apply to operations covered under Act 78 of 1993 and Act 168 of 1968.

Column B:

Apply to operations covered under Act 57 of 1963, Act 26 of 1978, Act 52 of 1983 and Act 8 of 1987.

Column C:

Apply to operations covered under Act 148 of 1988, Act 75 of 1995, Act 225 of 1995, Act 14 of 1996 and fully taxable operations.

Column A

Column B

Column C

1.

Net income subject to normal tax:

00

00

a)

Schedule L Incentives, Part I, line 5 ............................................

(1a)

00

b)

Schedule M Incentives, Part I, line 10 .........................................

(1b)

00

c)

Schedule N Incentives, Part I, line 10 .........................................

(1c)

00

d)

Schedule P Incentives, Part I, line 7 ............................................

(1d)

2.

Total net income subject to normal tax (Add lines 1(a)

00

00

00

through 1(d)) ........................................................................................

(2)

00

00

00

3.

Less: Surtax net income credit (See instructions) ......................

(3)

00

00

00

4.

Net income subject to surtax .........................................................

(4)

00

00

00

5.

Normal tax ...........................................................................................

(5)

00

00

00

6.

Surtax .....................................................................................................

(6)

00

00

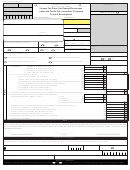

7.

Recovery of tax for differences in tax rates (See instructions) ..

(7)

00

00

00

8.

Total tax (Add lines 5 through 7) ....................................................

(8)

00

9.

Alternative Tax - Capital Gains (Schedule D Corp. and Part.) ...................

(9)

10.

Tax determined (Columns A and B, line 8; Column C,

00

00

00

line 8 or 9, whichever is smaller) .....................................................

(10)

11.

Credits:

a)

Credit for taxes paid to the United States, its possessions

00

00

00

and foreign countries ....................................................................

(11a)

b)

Special credits granted under Art. 41A-6 (Do not exceed 50%

00

of line 10) .........................................................................................

(11b)

c)

Credit of Section 3(a)(3) (Only for exempt businesses under

00

Act No. 8 of 1987) ...........................................................................

(11c)

Credit for investment in Capital Investment, Tourism, other

d)

00

00

00

funds or direct investments (Schedule Q) ......................................

(11d)

00

e)

Credit for the purchase of tax credits ..........................................

(11e)

Credit attributable to losses in Capital Investment, Tourism

f)

00

or other funds (Schedule Q).........................................................

(11f)

00

g)

Alternative minimum tax paid on previous years ........................

(11g)

00

h)

Credit for increase in investments .............................................

(11h)

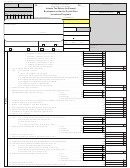

i)

Credit for Contributions to Educational Foundation for the

00

00

00

Free Selection of Schools ...............................................................

(11i)

j)

Credit for purchases of products manufactured in Puerto Rico

00

00

00

and Puerto Rican agricultural products (Schedule B1 Incentives)..

(11j)

Other credits not included on the preceding lines (Submit

k)

00

00

00

detail) (See instructions) ...............................................................

(11k)

00

00

00

L)

Total credits (Add lines 11(a) through 11(k)) ...............................

(11l)

12.

Tax liability before alternative minimum tax (Subtract

00

00

00

line 11(l) from line 10) .........................................................................

(12)

00

13.

Excess of alternative minimum tax over regular tax .....................

(13)

00

14.

Branch profits tax (Form AS 2879, see instructions) ...................

(14)

15.

Tax liability (Add lines 12 through 14. Enter here and on Form

00

00

00

480.30(II), Part I, line 1(a)) .................................................................

(15)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2