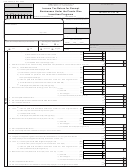

Schedule K Incentives - Attachment To The Form 480.30(Ii) - Computation Of Tax - 2002 Page 2

ADVERTISEMENT

Rev. 05.02

Schedule K Incentives - Page 2

Part II

Compensation to Officers

Percentage of

Percentage of corporation's

Compensation

Name of officer

Social security number

time devoted

stocks owned

to business

Common

Preferred

00

00

00

00

00

00

Total compensation to officers

00

Part III

Reconciliation of Taxable Income in Puerto Rico (Form 480.30(II)) and in the United States (Form 1120)

Column C

Column B

Column A

Items

Difference

United States

Puerto Rico

0 0

0 0

0 0

1.

Sales ........................................................................

(1)

0 0

0 0

0 0

2.

Cost of goods sold ...................................................

(2)

0 0

0 0

0 0

3.

Gross profit ..............................................................

(3)

0 0

0 0

0 0

4.

Interest .....................................................................

(4)

0 0

0 0

0 0

5.

Other income ...........................................................

(5)

0 0

0 0

0 0

6.

Total gross income ..................................................

(6)

0 0

0 0

0 0

7.

Total deductions.......................................................

(7)

0 0

0 0

0 0

8.

Net taxable income ..................................................

(8)

Explain difference:

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Part IV

Reconciliation of Passive Income

Reconciliation Unites States (Form 1120)

Reconciliation Puerto Rico (Form 480.30(II))

00

0 0

1.

Passive income per financial statements .

1.

Passive income per financial statements ....

(1)

(1)

2.

Schedule M-1 Adjustments:

2.

Adjustments:

(a)

(a)

(b)

(b)

(c)

(c)

(d)

(d)

0 0

(e)

(e) Total (Add lines 2(a) through 2(d)) .....

(2e)

(f)

3.

Net passive income from Puerto Rico

00

0 0

(g)

Total (Add lines 2(a) through 2(f)) .....

sources (Subtract line 2(e) from line 1) .....

(3)

(2g)

3.

Passive income as reported on Form 1120

4.

Less passive income:

00

0 0

(Subtract line 2(g) from line 1) .................

a.

Rental income reported on Schedule P Inc.....

(4a)

(3)

0 0

b.

Passive income reported on Schedule N Inc..

(4b)

0 0

c.

Passive income reported on Schedule M Inc.

(4c)

0 0

d.

Passive income reported on Schedule V Inc..

(4d)

0 0

e.

Total (Add lines 4(a) through 4(d)) ................

(4e)

0 0

5.

Difference (Subtract line 4(e) from line 3) .........

(5)

Explain difference:

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

____________________________________________________________________________________________________________

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2