2

Form 4720 (2017)

Page

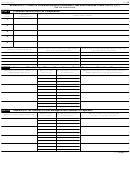

Part II-B

Summary of Taxes (See Tax Payments in the instructions.)

1

Enter the taxes listed in Part II-A, column (l), that apply to managers, self-dealers, disqualified

persons, donors, donor advisors, and related persons who sign this form. If all sign, enter the

total amount from Part II-A, column (l)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Total tax. Add Part I, line 13, and Part II-B, line 1 .

2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Total payments including amount paid with Form 8868 (see instructions) .

.

.

.

.

.

.

3

4

Tax due. If line 2 is larger than line 3, enter amount owed (see instructions) .

.

.

.

.

4

▶

5

Overpayment. If line 2 is smaller than line 3, enter the difference. This is your refund .

5

.

▶

SCHEDULE A—Initial Taxes on Self-Dealing (Section 4941)

Part I

Acts of Self-Dealing and Tax Computation

(a) Act

(b) Date

(c) Description of act

number

of act

1

2

3

4

5

(d) Question number from Form 990-PF,

(g) Tax on foundation managers (if

(f) Initial tax on self-dealer

Part VII-B, or Form 5227, Part VI-B,

(e) Amount involved in act

applicable) (lesser of $20,000 or 5% of

(10% of col. (e))

applicable to the act

col. (e))

Part II

Summary of Tax Liability of Self-Dealers and Proration of Payments

(d) Self-dealer’s total tax

(b) Act no. from

(c) Tax from Part I, col. (f),

(a) Names of self-dealers liable for tax

liability (add amounts in col. (c))

Part I, col. (a)

or prorated amount

(see instructions)

Part III

Summary of Tax Liability of Foundation Managers and Proration of Payments

(d) Manager’s total tax liability

(b) Act no. from

(c) Tax from Part I, col. (g),

(a) Names of foundation managers liable for tax

(add amounts in col. (c))

Part I, col. (a)

or prorated amount

(see instructions)

SCHEDULE B—Initial Tax on Undistributed Income (Section 4942)

1

Undistributed income for years before 2016 (from Form 990-PF for 2017, Part XIII, line 6d) .

1

2

2

Undistributed income for 2016 (from Form 990-PF for 2017, Part XIII, line 6e)

.

.

.

.

.

3

Total undistributed income at end of current tax year beginning in 2017 and subject to tax

under section 4942 (add lines 1 and 2)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Tax—Enter 30% of line 3 here and on Part I, line 1 .

.

.

.

.

.

.

.

.

.

.

.

.

.

4

4720

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10