3

Form 4720 (2017)

Page

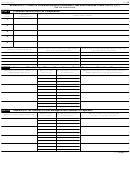

SCHEDULE C—Initial Tax on Excess Business Holdings (Section 4943)

Business Holdings and Computation of Tax

If you have taxable excess holdings in more than one business enterprise, attach a separate schedule for each enterprise. Refer to the

instructions for each line item before making any entries.

Name and address of business enterprise

Employer identification number .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

Form of enterprise (corporation, partnership, trust, joint venture, sole proprietorship, etc.) .

▶

(a)

(b)

(c)

Voting stock

Value

Nonvoting stock

(profits interest or

(capital interest)

beneficial interest)

1

Foundation holdings in business enterprise .

.

1

%

%

2

2

Permitted holdings in business enterprise .

.

%

%

3

Value of excess holdings in business enterprise

3

4

Value of excess holdings disposed of within 90

days; or, other value of excess holdings not

subject to section 4943 tax (attach statement)

4

5

Taxable excess holdings in business enterprise

— line 3 minus line 4 .

.

.

.

.

.

.

.

.

5

6

Tax—Enter 10% of line 5

.

.

.

.

.

.

.

6

7

Total tax—Add amounts on line 6, columns (a),

(b), and (c); enter total here and on Part I, line 2

7

SCHEDULE D—Initial Taxes on Investments That Jeopardize Charitable Purpose (Section 4944)

Part I

Investments and Tax Computation

(f) Initial tax on foundation

(e) Initial tax on

(a) Investment

(b) Date of

(d) Amount of

managers (if applicable)—

(c) Description of investment

foundation (10% of

number

investment

investment

(lesser of $10,000 or 10%

col. (d))

of col. (d))

1

2

3

4

5

Total—Column (e). Enter here and on Part I, line 3 .

.

.

.

.

.

.

.

.

.

.

.

.

Total—Column (f). Enter total (or prorated amount) here and in Part II, column (c), below .

.

.

.

.

.

Part II

Summary of Tax Liability of Foundation Managers and Proration of Payments

(a) Names of foundation managers liable for tax

(b) Investment

(c) Tax from Part I, col. (f), or prorated

(d) Manager’s total tax liability

no. from Part I,

amount

(add amounts in col. (c))

col. (a)

(see instructions)

4720

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10