5

Form 4720 (2017)

Page

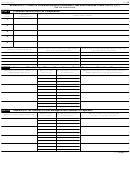

SCHEDULE G—Tax on Excess Lobbying Expenditures (Section 4911)

1

Excess of grass roots expenditures over grass roots nontaxable amount (from Schedule C (Form

990 or 990-EZ), Part II-A, column (b), line 1h). (See the instructions before making an entry.)

.

.

1

2

Excess of lobbying expenditures over lobbying nontaxable amount (from Schedule C (Form 990 or

990-EZ), Part II-A, column (b), line 1i). (See the instructions before making an entry.) .

.

.

.

.

2

3

Excess lobbying expenditures—enter the larger of line 1 or line 2

.

.

.

.

.

.

.

.

.

.

.

3

4

Tax—Enter 25% of line 3 here and on Part I, line 6 .

4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

SCHEDULE H—Taxes on Disqualifying Lobbying Expenditures (Section 4912)

Part I

Expenditures and Computation of Tax

(f) Tax imposed on organization

(a) Item

(c) Date paid or

(e) Tax imposed on organization

(b) Amount

(d) Description of lobbying expenditures

managers (if applicable)—

number

incurred

(5% of col. (b))

(5% of col. (b))

1

2

3

4

5

Total—Column (e). Enter here and on Part I, line 7 .

.

.

.

.

.

.

.

.

Total—Column (f). Enter total (or prorated amount) here and in Part II, column (c), below .

.

.

.

.

.

Part II

Summary of Tax Liability of Organization Managers and Proration of Payments

(d) Manager’s total tax liability

(b) Item no. from

(c) Tax from Part I, col. (f), or

(a) Names of organization managers liable for tax

(add amounts in col. (c))

Part I, col. (a)

prorated amount

(see instructions)

SCHEDULE I—Initial Taxes on Excess Benefit Transactions (Section 4958)

Part I

Excess Benefit Transactions and Tax Computation

(a)

(b) Date of transaction

(c) Description of transaction

Transaction

number

1

2

3

4

5

(f) Tax on organization managers

(e) Initial tax on disqualified persons

(d) Amount of excess benefit

(if applicable) (lesser of

(25% of col. (d))

$20,000 or 10% of col. (d))

4720

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10