4

Form 4720 (2017)

Page

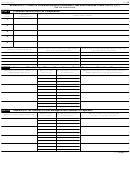

SCHEDULE E—Initial Taxes on Taxable Expenditures (Section 4945)

Part I

Expenditures and Computation of Tax

(a) Item

(c) Date paid

(e) Description of expenditure and purposes

(b) Amount

(d) Name and address of recipient

number

or incurred

for which made

1

2

3

4

5

(h) Initial tax imposed on foundation

(f) Question number from Form 990-PF, Part VII-B, or

(g) Initial tax imposed on foundation

managers (if applicable)—(lesser of

Form 5227, Part VI-B, applicable to the expenditure

(20% of col. (b))

$10,000 or 5% of col. (b))

Total—Column (g). Enter here and on

Part I, line 4

.

.

.

.

.

.

.

.

.

.

Total—Column (h). Enter total (or prorated amount) here and in Part II, column (c),

below

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part II

Summary of Tax Liability of Foundation Managers and Proration of Payments

(d) Manager’s total tax liability

(b) Item no. from

(c) Tax from Part I, col. (h), or

(a) Names of foundation managers liable for tax

(add amounts in col. (c))

Part I, col. (a)

prorated amount

(see instructions)

SCHEDULE F—Initial Taxes on Political Expenditures (Section 4955)

Part I

Expenditures and Computation of Tax

(e) Initial tax imposed on

(f) Initial tax imposed on

(a) Item

(c) Date paid

managers (if applicable) (lesser

(b) Amount

(d) Description of political expenditure

organization or foundation

number

or incurred

of $5,000 or 2½% of col. (b))

(10% of col. (b))

1

2

3

4

5

Total—Column (e). Enter here and on Part I, line 5 .

.

.

.

.

.

.

.

.

.

Total—Column (f). Enter total (or prorated amount) here and in Part II, column (c), below .

.

.

.

.

Part II

Summary of Tax Liability of Organization Managers or Foundation Managers and Proration of Payments

(d) Manager’s total tax liability

(a) Names of organization managers or

(b) Item no. from

(c) Tax from Part I, col. (f), or

(add amounts in col. (c))

foundation managers liable for tax

Part I, col. (a)

prorated amount

(see instructions)

4720

Form

(2017)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10