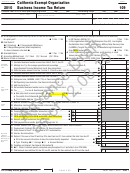

Arizona Form 99t Draft - Arizona Exempt Organization Business Income Tax Return - 2007 Page 2

ADVERTISEMENT

Name:

EIN:

AZ Form 99T (2007)

Page 2 of 2

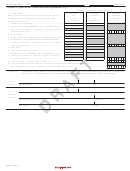

Schedule A - Apportionment Formula (Multistate Organizations Only)

See instructions, pages 5 and 6.

Limited to Unrelated Trade or Business Amounts

Column A

Column B

Column C

A1 Property Factor

Total

Total Within

Ratio Within

Value of real and tangible personal property (by averaging the value of

Within

and

Arizona

owned property at the beginning and end of the tax period; rented

A ÷ B

Arizona

Without Arizona

property at capitalized value)

a. Total owned and rented property ...........................................................................

X 1

OR

X 2

b. Weight Arizona property (STANDARD uses X 1; ENHANCED uses X 2).....

c. Property factor (for column A - multiply item a by item b; for column B -

enter amount from item a) .......................................................................

•

A2 Payroll Factor

a. Wages, salaries, commissions and other compensation of employees ...

X 1

OR

X 2

b. Weight Arizona payroll - (STANDARD uses X 1; ENHANCED uses X 2) ........

c. Payroll factor (for column A - multiply item a by item b; for column B -

enter amount from item a) .......................................................................

•

A3 Sales Factor

a. Total sales and other gross receipts ........................................................

X 2

OR

X 6

b. Weight Arizona sales - (STANDARD uses X 2; ENHANCED uses X 6) .......

c. Sales factor (for column A - multiply item a by item b; for column B -

enter amount from item a) .......................................................................

•

A4 Total ratio - add A1(c), A2(c) and A3(c), in column C ...........................................................................................................................

•

A5 Average apportionment ratio - divide line A4, Column C, by the denominator (STANDARD divides by four (4);

ENHANCED divides by ten (10)). Enter the result in column C, and on page 1, line 2 ........................................................................

•

Certifi cation

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and

belief, it is a true, correct and complete return, made in good faith, for the taxable year stated pursuant to the income tax laws of the State of Arizona.

Please

Signature of offi cer

Date

Title

Sign Here

Paid

Preparer’s signature

Date

Preparer’s

Use Only

Firm’s name (or preparer’s, if self-employed)

Preparer’s TIN

Firm’s address

Zip code

ADOR 91-0023 (07)

DRAFT 081607

DRAFT 081607

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2