Employers' Guide To Workers' Compensation Insurance In Washington State Page 32

ADVERTISEMENT

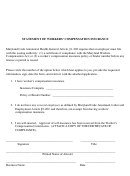

Appendix C

This information is provided as a quick reference guide. While we make every effort to ensure it is correct,

it is not intended to replace L&I’s or the insured’s policies, procedures, RCWs or WACs in their entirety.

Responsibility for

nature as the contract, or the individual has

a principle place of business eligible for IRS

Independent Contractors

business deduction, and

4. The individual is responsible for filing a

All businesses

schedule of expense and income with the

IRS for the business, and

If you enter into a contract with an independent

contractor, you may be required to provide

5. Has an active account with the Department

workers’ compensation insurance coverage

of Revenue and other state agencies,

during the period of the contract. You must

as required, for the business they are

cover the contractor if he or she is a worker as

conducting under the contract, and an

defined in the workers’ compensation laws. That

active unified business identifier number

definition (see Appendix A) includes workers

(UBI) with the State of Washington, and

“... working under an independent contract, the

6. The individual maintains a separate set

essence of which is his or her personal labor.”

of books and records that reflect items of

income and expense for the business.

Not understanding your requirements can

leave your business vulnerable to unexpected

Additional responsibilities for

premiums, penalties and even lawsuits from

independent contractors and their employees.

construction and electrical contractors

RCW 51.08.195 gives an employer an alternative

If you are a construction or electrical contractor,

six-part test to determine if an independent

you must follow the six-part test above and

contractor is exempt from mandatory workers’

apply a seventh part to determine whether an

compensation coverage and other requirements,

individual is exempt from mandatory coverage.

such as unemployment tax.

(See RCW 51.08.181.)

The six-part test states that a person is exempt if:

7. The individual must have a valid contractor

registration pursuant to Chapter 18.27 RCW

1. He or she is free from control or direction

or an electrical contractor license pursuant

over the performance of the services, and

to Chapter 19.28 RCW.

2. The service provided is outside the usual

course of business or it is performed outside all

of the places of business of the hiring enterprise

or the hired individual is responsible, both

under the contract and in fact, for the costs of

Questions on Independent Contractor status and

the principal place of business from which the

liability for workers’ compensation reporting?

service is performed, and

Contact the Workers’ Compensation Coverage

3. The individual is engaged in an

Determinations Unit at 509-324-2627 or email

independently established trade of the same

Determinations@Lni .wa .gov

28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40