Employers' Guide To Workers' Compensation Insurance In Washington State Page 33

ADVERTISEMENT

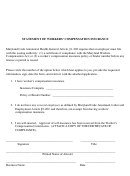

Appendix C

Liability for Unpaid Workers’

ƒ

Your subcontractor has a workers’

compensation account in good standing with

Compensation Premiums

L&I,* or is certified by L&I as self-insured.

-

You must verify this when you hire a

You might have to pay someone else’s

subcontractor and each year by checking their

workers’ comp premiums

“Certificate of Workers’ Compensation

Coverage” at .

In the construction industry, you can protect

Print it and keep it on file, then remember

yourself from liability for your subcontractor’s

to check it again a year later.

unpaid premiums by ensuring ALL of the

-

You may also fill out a “Subcontractor

following requirements are met:

Tracking Request” online for your

ƒ

You, the prime contractor, and your

subcontractor, and L&I will notify you

subcontractor(s) are registered as contractors

if your subcontractor falls behind on

under Chapter 18.27 RCW or licensed under

workers’ compensation requirements.

Chapter 19.28 RCW.

*If your subcontractor is a sole proprietor who

ƒ

Your contracted work is the work of a

meets all the above requirements but does not

contractor as described in RCW 18.27.010.

have employees, he or she is not required to have

ƒ

Your subcontractor maintains a set of books

a workers’ compensation account.

and records that reflect all of the business’s

income and expenses. (You need to review

You must ensure that all of the above requirements

them for your protection.)

are met to receive protection from liability for your

subcontractor’s unpaid premiums.

ƒ

Your subcontractor works out of his or her

own storefront location or home office that

Note: You should also verify that an independent

is used regularly and exclusively for the

contractor or subcontractor you are hiring has an

business and is eligible for an IRS business

active Department of Revenue tax registration

deduction. (You need to visit the place of

account. Find out at .

business and make sure.)

ƒ

You are not supervising your subcontractor

or his or her own employees. (See Independent

Contractor Guide: A Step-by-Step Guide to

Hiring Independent Contractors in Washington

State on the Web at

IPUB/101-063-000.pdf .)

IMPORTANT NOTE:

Contractors should be aware that, under workers’ compensation law (Chapter 51 . 1 2 RCW), it is unlawful

for any county, city or town to issue a construction building permit to any person who has not submitted an

estimate of payroll to L&I and paid the required premiums . If the person qualifies for self-insurance, he/she

must show proof of self-insurance certification before a permit can be granted .

29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40