Instructions For Form De 88/de 88all - Payroll Tax Deposit Coupon - Employment Development Department

ADVERTISEMENT

INSTRUCTIONS FOR PREPARING THE DE 88/DE 88 ALL

PAYROLL TAX DEPOSIT COUPON

The Employment Development Department (EDD) now has a new toll-free number, (888) 745-3886, for customers to call for

general payroll tax and filing requirement information. Speech and hearing impaired customers may contact us on our TTY line

at (800) 547-9565. Agents are available to answer questions on normal workdays from 7:30 a.m. to 5:30 p.m. Pacific Standard

Time. No agents are available on weekends and on State holidays.

The EDD also offers information 24 hours a day, 7 days a week, by telephone on:

•

Forms and Publications - Call (888) 745-3886 to order payroll tax forms, instructions, and publications.

•

E-Z Access Information Topics - Call (877) 547-4503 and listen to recorded messages covering more than 50 payroll tax

topics. If you are an out-of-state employer, please call (888) 745-3886, or write to:

Employment Development Department

3321 Power Inn Road, Suite 220

Sacramento, CA 95826-6110

For your TAX RATE INFORMATION, please refer to either your Notice of Contribution Rates and Statement of UI Reserve

Account (DE 2088) mailed to you under separate cover or call the Contribution Rate Group’s (CRG) Automated Call Processing

(ACP) line at (916) 653-7795.

TABLE OF CONTENTS

TOPIC

PAGE

GENERAL INFORMATION - Payroll Tax Definitions, Payroll Taxes, Computing Payroll Taxes, Other ................................ 1

PAYMENT DUE DATES - For Next Banking Day, Semi-weekly, Monthly, and Quarterly Filers .......................................... 2

COMMON ERRORS TO AVOID WHEN COMPLETING A DE 88/DE 88ALL COUPON ..................................................... 3

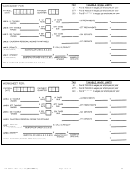

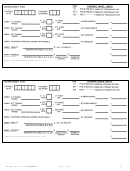

INSTRUCTIONS FOR COMPLETING DE 88/DE 88ALL COUPONS ................................................................................. 3

TAXABLE WAGES - Taxable Wage Limits and how to Calculate ....................................................................................... 4

HOW TO CALCULATE PAYMENT AMOUNTS (including Penalty and Interest) ................................................................. 5 - 9

SAMPLE OF A COMPLETED DE 88ALL (late Quarterly payment) ..................................................................................... 9

WORKSHEETS FOR CALCULATING PAYROLL TAXES .................................................................................................... 10 - 11

EMPLOYER RECORD OF CALIFORNIA TAX/WITHHOLDING DEPOSITS ......................................................................... 12

DE 88 COUPON BOOKLET REORDER FORM ................................................................................................................... 13

CHANGE OF ADDRESS OR BUSINESS/FINAL REPORT FORM ...................................................................................... 13 - 14

DE 88ALL-I Rev. 14 (1-02) (INTERNET)

Page i of 14

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15