Instructions For Form De 88/de 88all - Payroll Tax Deposit Coupon - Employment Development Department Page 2

ADVERTISEMENT

GENERAL INFORMATION

PAYROLL TAX DEFINITIONS

California Personal Income

Employers may be required to withhold California PIT from their individual employee

Tax (PIT) -

wages.

State Disability Insurance (SDI) - Subject employers must withhold SDI from individual employee wages to the taxable wage

limit.

Unemployment Insurance (UI) - Subject employers are responsible for paying UI on individual employee wages to the

taxable wage limit.

Employment Training Tax (ETT) - Employers with a positive reserve account balance are required to pay ETT on individual

employee wages to the taxable wage limit.

PAYROLL TAXES

•

An employer’s UI contribution rate is based on their reserve account balance and may fluctuate annually.

•

Employers with a positive reserve account balance pay ETT.

•

The SDI rate is the same for all employers and may fluctuate annually.

•

PIT withholding schedules are located in the 2002 California Payroll Tax Guide (DE 44P) mailed under separate cover.

If you do not have this guide, contact Account Services Group at (916) 654-7041.

•

Payment of UI and ETT is not due until the end of the quarter.

- If you prepay your UI and ETT along with your Next Banking Day, Semi-Weekly, or Monthly deposits of SDI and PIT, no UI

and ETT deposit is required at the end of the quarter.

- If you do not prepay your UI and ETT taxes with your Next Banking Day, Semi-Weekly, or Monthly deposits of SDI and PIT,

you will be required to make a UI and ETT deposit at the end of the quarter.

•

Penalty and interest will be charged for late deposits/payments. Refer to PAYMENT DUE DATES on page 2.

COMPUTING PAYROLL TAXES

•

Instructions for calculating taxable wages and payment amounts can be found on pages 4 through 9.

•

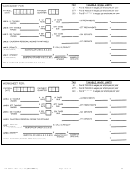

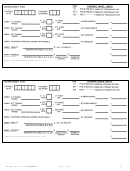

Use the worksheets found on pages 10 and 11 for computing the amount of your payroll tax payments.

•

Record your payroll tax deposits/payments on the Employer Record of California Tax/Withholdings Deposits found on

page 12.

OTHER

•

If you have a change of mailing address, change in ownership, or have quit doing business, complete the CHANGE OF

ADDRESS or BUSINESS/FINAL REPORT FORM on page 13-14 and mail it to the address shown on the form. ADDRESS

CHANGES MADE ON THE DE 88ALL CANNOT BE PROCESSED.

•

Use the Reorder Form on page 13 to request a personalized preprinted coupon booklet. Please allow six weeks for

delivery.

•

If you want a receipt other than your cancelled check, prepare a letter requesting a receipt and include it, along with a self-

addressed stamped envelope, with your deposit/payment.

TO AUTOMATE YOUR PAYROLL TAX PAYMENTS AND ELIMINATE PREPARATION OF A DE 88/DE 88ALL COUPON, USE

ELECTRONIC FUNDS TRANSFER (EFT). CONTACT OUR EFT UNIT AT (916) 654-9130 OR FAX (916) 654-7441 FOR MORE

INFORMATION. You may also refer to page 34 in the 2002 California Employer’s Guide (DE 44) for information about EFT.

DE 88ALL-I Rev. 14 (1-02) (INTERNET)

Page 1 of 14

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15