Instructions For Form De 88/de 88all - Payroll Tax Deposit Coupon - Employment Development Department Page 10

ADVERTISEMENT

HOW TO CALCULATE PAYMENT AMOUNTS - INTEREST AMOUNTS

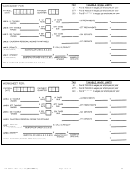

INTEREST FOR A LATE QUARTERLY PAYMENT

Interest will be changed on the UI, ETT, SDI, and PIT amounts for any late Quarterly Payment.

· The UI is $238.00.

Example:

· The ETT is $7.00.

· The SDI is $72.00.

· The PIT withheld is $200.00.

· A quarterly payment was due on April 2, 2002, and is considered late on May 1.

· The quarterly payment was due postmarked on May 10, 2002, and is 10 days late.

Calculation:

UI Quarterly Payments

$

238.00

ETT Quarterly Payment

7.00

SDI Withheld

72.00

+

PIT Withheld

+

200.00

Taxes Due

$

517.00

x

10% Penalty

x

.10

Penalty

$

51.70

+

Taxes Due

+

517.00

Amount Subject to Interest Calculation

$

568.70

x

Daily Interest Factor*

x .0001918

Daily Interest

0.109077

x

Number of Days Late

x

10

INTEREST DUE

$

1.09

(ENTER IN BOX 4F ON COUPON)

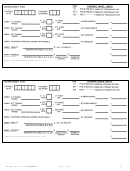

PAYROLL TAX DEPOSIT DE 88ALL

(TYPE OR PRINT IN BLACK INK ONLY):

1. PAYROLL DATE:

2. PAYMENT TYPE:

4. PAYMENT AMOUNTS:

Rate

Tax

(MARK ONE BOX ONLY)

MUST BE COMPLETED

STATE OF CALIFORNIA

NEXT

,

,

0 3 3 1 0 2

A)

UI

2 3 8 0 0

EMPLOYMENT DEVELOPMENT

BANKING

DEPARTMENT

DAY

P O BOX 826276

(Last PAYROLL DATE covered by deposit)

SACRAMENTO, CA 94230-6276

SEMI-

,

,

B)

ETT

7 0 0

WEEKLY

SANDRA JONES

Employer Name

,

,

7 2 0 0

C)

SDI

MONTHLY

Employer DBA

JONES’ FLOWER COMPANY

California

2 0 0 0 0

,

,

X

D)

QUARTERLY

PIT

Indicate your Account Number here; Please enter on your check

5 1 7 0

3. PAYMENT

,

,

1 2 3 4

1 2 3

5

0 2 1

E)

Penalty

QUARTER

F)

,

,

Interest

1 0 9

EMPLOYMENT DEVELOPMENT DEPT.

TOTAL

,

,

5 6 9 7 9

G )

PAID

01880198

PAY THIS AMOUNT

TOTAL LINES A THROUGH F.

DO NOT FOLD OR STAPLE.

Make check payable to EDD.

PREPARER’S

TELEPHONE NO.

SANDRA JONES

(

)

310

555-1212

X

DE 88ALL Rev. 14 (3-01)

DEPARTMENT USE ONLY

DE 88ALL-I Rev. 14 (1-02) (INTERNET)

Page 9 of 14

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15