Non-Resident Employee Earnings Allocation And/or Deductible Employee Business Expenses Report - 2003

ADVERTISEMENT

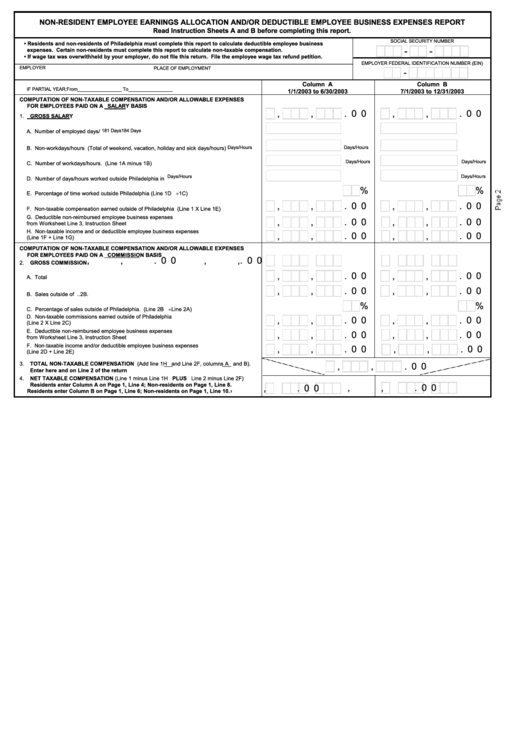

NON-RESIDENT EMPLOYEE EARNINGS ALLOCATION AND/OR DEDUCTIBLE EMPLOYEE BUSINESS EXPENSES REPORT

Read Instruction Sheets A and B before completing this report.

SOCIAL SECURITY NUMBER

• Residents and non-residents of Philadelphia must complete this report to calculate deductible employee business

-

-

expenses. Certain non-residents must complete this report to calculate non-taxable compensation.

• If wage tax was overwithheld by your employer, do not file this return. File the employee wage tax refund petition.

EMPLOYER FEDERAL IDENTIFICATION NUMBER (EIN)

EMPLOYER

PLACE OF EMPLOYMENT

-

Column A

Column B

IF PARTIAL YEAR:

From_________________ To_________________

1/1/2003 to 6/30/2003

7/1/2003 to 12/31/2003

COMPUTATION OF NON-TAXABLE COMPENSATION AND/OR ALLOWABLE EXPENSES

FOR EMPLOYEES PAID ON A SALARY BASIS

,

,

. 0 0

,

,

. 0 0

1. GROSS SALARY.........................................................................................................................1.

181 Days

184 Days

A. Number of employed days/hours..........................................................................................1A.

Days/Hours

Days/Hours

B. Non-workdays/hours (Total of weekend, vacation, holiday and sick days/hours)..................1B.

Days/Hours

Days/Hours

C. Number of workdays/hours. (Line 1A minus 1B)..................................................................1C.

Days/Hours

Days/Hours

D. Number of days/hours worked outside Philadelphia in 1C.....................................................1D.

%

%

E. Percentage of time worked outside Philadelphia (Line 1D ÷ 1C)...........................................1E.

,

,

. 0 0

,

,

. 0 0

F. Non-taxable compensation earned outside of Philadelphia (Line 1 X Line 1E)......................1F.

G. Deductible non-reimbursed employee business expenses

,

,

. 0 0

,

,

. 0 0

from Worksheet Line 3, Instruction Sheet B..........................................................................1G.

H. Non-taxable income and or deductible employee business expenses

,

,

. 0 0

,

,

. 0 0

(Line 1F + Line 1G)...............................................................................................................1H.

COMPUTATION OF NON-TAXABLE COMPENSATION AND/OR ALLOWABLE EXPENSES

FOR EMPLOYEES PAID ON A COMMISSION BASIS

,

,

. 0 0

,

,

. 0 0

2. GROSS COMMISSION...............................................................................................................2.

,

,

. 0 0

,

,

. 0 0

A. Total sales............................................................................................................................2A.

,

,

. 0 0

,

,

. 0 0

B. Sales outside of Philadelphia................................................................................................2B.

%

%

C. Percentage of sales outside of Philadelphia. (Line 2B ÷ Line 2A)........................................2C.

D. Non-taxable commissions earned outside of Philadelphia

,

,

. 0 0

,

,

. 0 0

(Line 2 X Line 2C).................................................................................................................2D.

E. Deductible non-reimbursed employee business expenses

,

,

. 0 0

,

,

. 0 0

from Worksheet Line 3, Instruction Sheet B..........................................................................2E.

F. Non-taxable income and/or deductible employee business expenses

,

,

. 0 0

,

,

. 0 0

(Line 2D + Line 2E)...............................................................................................................2F.

3. TOTAL NON-TAXABLE COMPENSATION (Add line 1H and Line 2F, columns A and B).

,

,

. 0 0

Enter here and on Line 2 of the return.....................................................................................3.

4. NET TAXABLE COMPENSATION (Line 1 minus Line 1H PLUS Line 2 minus Line 2F)

Residents enter Column A on Page 1, Line 4; Non-residents on Page 1, Line 8.

,

,

. 0 0

,

,

. 0 0

Residents enter Column B on Page 1, Line 6; Non-residents on Page 1, Line 10.................4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1