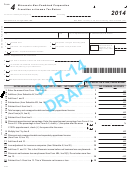

Page 4 of 14

2015 Form 6 - Wisconsin Combined Corporate Franchise or Income Tax Return

Designated Agent Name

Federal Employer ID Number

Corporation Name:

Elimination

Combined

FEIN:

Adjustments

Totals

23

Pension plan, etc . . . . . . . . . . . . . . . . . . . . . 23

23

.00

.00

.00

.00

.00

24

Employee benefit programs . . . . . . . . . . . . . 24

24

.00

.00

.00

.00

.00

25

Domestic production activities deduction . . . 25

.00

.00

.00

.00

25

.00

26

Other deductions . . . . . . . . . . . . . . . . . . . . . 26

26

.00

.00

.00

.00

.00

27

Total deductions. Add lines 12 through 26 27

27

.00

.00

.00

.00

.00

28

Taxable income or loss. Subtract line 27

from line 11. The combined total excluding

the elimination adjustments should equal

28

Form 6, Page 2, line 5 . . . . . . . . . . . . . . . . . 28

.00

.00

.00

.00

.00

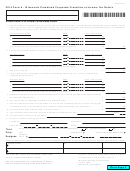

29

Net capital gains included on line 28

29

(enter as a negative in member columns) . . 29

.00

.00

.00

.00

.00

30

Recomputed net capital gain, applying capital

loss limitation at combined group level . . . . . 30

30

.00

.00

.00

.00

.00

31

Sum of charitable contributions deduction,

net section 1231 losses, and losses from

involuntary conversions included on line 28

(enter as a positive in member columns) . . . 31

31

.00

.00

.00

.00

.00

32

Sum of recomputed charitable contributions

deduction, net section 1231 losses, and

losses from involuntary conversions,

applying limitations at combined group level

(enter as a negative in member columns) . . 32

32

.00

.00

.00

.00

.00

33

Adjustment to defer or recognize intercompany

income, expense, gain, or loss between group

members . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

33

.00

.00

.00

.00

.00

34

Other adjustments based on federal law

(explain on an attached statement) . . . . . . . 34

34

.00

.00

.00

.00

.00

35

Combine lines 28 through 34. Enter on

Form 6, Part II, line 1, on the next page . . . . 35

35

.00

.00

.00

.00

.00

Go to Page 5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14