Page 5 of 14

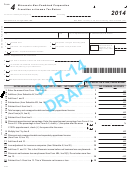

2015 Form 6 - Wisconsin Combined Corporate Franchise or Income Tax Return

Designated Agent Name

Federal Employer ID Number

Part II: Unitary Income Computation

Corporation Name:

Elimination

Combined

FEIN:

Adjustments

Totals

1 M odified federal taxable income from

Part I, line 35 . . . . . . . . . . . . . . . . . . . . . . 1

.00

.00

.00

.00

1

.00

2 Additions to income:

a Interest income from state and

2a

municipal obligations . . . . . . . . . . . . . 2a

.00

.00

.00

.00

.00

.00

.00

.00

.00

2b

.00

b State taxes accrued or paid . . . . . . . . 2b

c Related entity expenses (from

Schedule RT Part I, Sch. 2K-1, and

Sch. 3K-1) . . . . . . . . . . . . . . . . . . . . . 2c

2c

.00

.00

.00

.00

.00

d Domestic production activities

2d

deduction . . . . . . . . . . . . . . . . . . . . . . 2d

.00

.00

.00

.00

.00

e Expenses related to nontaxable

2e

income . . . . . . . . . . . . . . . . . . . . . . . . 2e

.00

.00

.00

.00

.00

f Basis, section 179, depreciation

2f

difference . . . . . . . . . . . . . . . . . . . . . . 2f

.00

.00

.00

.00

.00

g Amount by which the federal basis of

assets disposed of exceeds the

Wisconsin basis (attach schedule) . . . 2g

2g

.00

.00

.00

.00

.00

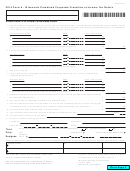

h Total additions for certain credits

computed:

a Community rehabilitation program

2h-a

credit . . . . . . . . . . . . . . . . . . . . . . . . 2h-a

.00

.00

.00

.00

.00

2h-b

b Development zones credits . . . . . . 2h-b

.00

.00

.00

.00

.00

2h-c

c Economic development credit . . . . 2h-c

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

d Enterprise zone jobs credit . . . . . . . 2h-d

2h-d

.00

.00

.00

.00

2h-e

.00

e Farmland preservation credit . . . . . 2h-e

f Jobs tax credit . . . . . . . . . . . . . . . . 2h-f

.00

.00

.00

.00

2h-f

.00

2h-g

g Manufacturing investment credit . . 2h-g

.00

.00

.00

.00

.00

h Manufacturing and agriculture credit 2h-h

.00

.00

.00

.00

2h-h

.00

i

Research credits . . . . . . . . . . . . . . 2h-i

2h-i

.00

.00

.00

.00

.00

Go to Page 6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14