Page 8 of 14

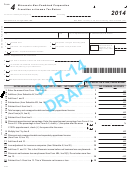

2015 Form 6 - Wisconsin Combined Corporate Franchise or Income Tax Return

Designated Agent Name

Federal Employer ID Number

Part III: Member’s Share of Form 6 Items

Corporation Name:

Combined

Totals

FEIN:

1a Apportionment numerator from column (a)

of Form A-1 or Part II of Form A-2 . . . . . . . 1a

1a

.00

.00

.00

.00

1b Apportionment denominator from column

(b) of Form A-1 or Part II of Form A-2 . . . . 1b

1b

.00

.00

.00

.00

1c Enter combined total amount from line 1b . 1c

.00

.00

.00

1d Apportionment percentage . Divide the

.

.

.

.

amount on line 1a by the amount on line 1c 1d

1d

%

%

%

%

Check if apportionment is from Form A-2 . .

2

Multiply Part II, line 8, by line 1d. See Instr. . 2

.00

.00

.00

2

.00

3

Adjustment for current year loss offset (see

3

instructions) . . . . . . . . . . . . . . . . . . . . . . . . 3

.00

.00

.00

.00

4

Wisconsin net nonapportionable and

separately apportioned income

4

.00

.00

.00

.00

(from Form N, line 14) . . . . . . . . . . . . . . . . 4

5

Net capital loss adjustment

(from Form 6CL, Part I, line 9e) . . . . . . . . . 5

.00

.00

.00

.00

5

6

Loss adjustment for insurance companies

(from Schedule 6I, line 24) . . . . . . . . . . . . . 6

.00

.00

.00

6

.00

7 Wisconsin net business loss carryforward

.00

.00

.00

7

.00

(from Part IV, line 18 of this form) . . . . . . . 7

8

Wisconsin net income (lines 2 + 3 + 4 - 5

+ 6 - 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

.00

.00

.00

8

.00

9

Gross tax (generally = 7.9% x (lines 2 + 3

+ 4 - 5 - 7). See instructions . . . . . . . . . . . . 9

.00

.00

.00

9

.00

10

Nonrefundable credits

10

(from Part V, line 5 of this form) . . . . . . . . 10

.00

.00

.00

.00

11

Economic development surcharge:

a Enter gross receipts from all activities . . . 11a

.00

.00

.00

11a

.00

b If line 11a is $4 million or greater, fill in

the member’s gross franchise or income

11b

tax from Form 6, Part III, line 9 . . . . . . . . 11b

.00

.00

.00

.00

c Multiply line 11b by 3% (.03) and fill in the

result. If the result is less than $25, fill in

$25.If the result is more than $9,800, fill

.00

.00

.00

in $9,800 . . . . . . . . . . . . . . . . . . . . . . . . . 11c

11c

.00

Go to Page 9

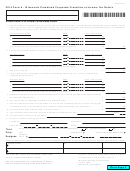

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14