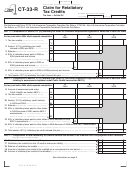

Form Ct-33-R - Claim For Retaliatory Tax Credits - 2012 Page 2

ADVERTISEMENT

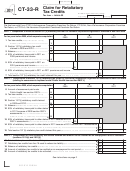

Page 2 of 2 CT-33-R (2012)

Instructions

Part 3 — Computation of total retaliatory tax

Temporary deferral of certain tax credits

credits claimed and amount to be credited as an

For tax years beginning on or after January 1, 2010, and before

overpayment and/or refunded (sections 1511(c) and

January 1, 2013, if the total amount of certain credits that you

1511(i))

may use to reduce your tax or have refunded to you is greater

than $2 million, the excess over $2 million must be deferred

Line 16 — Enter the total amounts of retaliatory tax

to, and used or refunded in, tax years beginning on or after

credits claimed this year from lines 7 and 15 pursuant to

January 1, 2013. For more information about the credit deferral,

sections 1511(c) and 1511(i).

see Form CT-500, Corporation Tax Credit Deferral.

Line 17 — Enter the total retaliatory tax credits claimed and

If you are subject to the credit deferral, you must complete all

used, which may reduce the total tax due to zero. If your total

credit forms without regard to the deferral. However, the credit

credits from all sources are $2 million or less, enter the amount

amount that is transferred to your tax return to be applied

from line 17 on your franchise tax return.

against your tax due or to be refunded to you may be reduced.

Enter this amount in the appropriate box on Form CT-33, above

Follow the instructions for Form CT-500 to determine the

line 101; Form CT-33-NL, above line 47; or Form CT-33-A,

amounts to enter on your tax return.

above line 116.

Part 1 — Computation of Article 33 section 1511(c)

If your total credits from all sources are more than $2 million,

retaliatory tax credit for insurance corporations

you may be subject to the temporary credit deferral. Complete

organized or domiciled in New York State

line 17 but do not enter the amount from line 17 on your

franchise tax return. See Form CT-500, Schedule D, column C

Insurance corporations organized or domiciled in New York

to determine the proper amount to enter on your franchise tax

State should complete Part 1 to claim credit for 90% of

return.

retaliatory taxes paid to other states for the privilege of doing

business in those states.

Lines 18, 19, and 20 — The balance of the retaliatory tax credit

a. You may claim credit only for retaliatory taxes paid on

computed on line 18 may be either credited as an overpayment

business after December 31, 1973.

on line 19 or claimed as a refund (without interest) on line 20.

b. Credit may not exceed the tax payable under Article 33

If your total credits from all sources are $2 million or less, you

(before adding the tax surcharge) for the tax year for which

are not subject to the temporary credit deferral. Enter the

the retaliatory taxes were imposed or assessed.

amounts from lines 19 and 20 on your franchise tax return.

c. Claim credit on the return for the tax year during which the

Include the line 19 amount on Form CT-33, line 27b;

retaliatory taxes were paid.

Form CT-33-NL, line 21b; or Form CT-33-A, line 32b.

d. This form does not include the surcharge retaliatory tax

credit allowed under Article 33 section 1505-a(d). The

Include the line 20 amount on Form CT-33, line 27a;

surcharge retaliatory tax credit will be computed on

Form CT-33-NL, line 21a; or Form CT-33-A, line 32a.

Form CT-33-M, Insurance Corporation MTA Surcharge

If your total credits from all sources are more than $2 million,

Return, and allowed only against the surcharge computed

you may be subject to the temporary credit deferral. Complete

under section 1505-a.

lines 19 and 20 but do not enter the amounts from lines 19 and

Any reduction in the amount of retaliatory taxes paid to another

20 on your franchise tax return. See Form CT-500 to determine

state on which a credit for such taxes was allowed by New York

the proper amounts to enter on your franchise tax return.

State must be reported to the Tax Department within 90 days of

final determination.

Retaliatory prints

Do not send the documentation for this credit (retaliatory prints)

Part 2 — Computation of section 1511(i) retaliatory

with your franchise tax return. Send the documentation to:

tax credit for insurance corporations organized or

NYS TAX DEPARTMENT

domiciled in New York State (relating to assessments

I/FDAB - AUDIT 9

imposed under Public Health Law section 2807-t)

W A HARRIMAN CAMPUS

ALBANY NY 12227

Insurance corporations organized or domiciled in New

York State should complete Part 2 to claim a credit for

Need help? and Privacy notification

up to 90% of the retaliatory taxes paid to other states

because of the assessment imposed by Public Health Law

See Form CT-1, Supplement to Corporation Tax Instructions.

section 2807-t. Claim credit on the return for the year during

which the retaliatory taxes were paid. The amount of the

credit claimed may not exceed the lesser of the amount of the

assessment paid under section 2807-t, or the tax payable under

Article 33 for the tax year for which the retaliatory taxes were

imposed or assessed.

501002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2