Instructions For Form M-36 - Combined Claim For Refund Of Fuel Taxes

ADVERTISEMENT

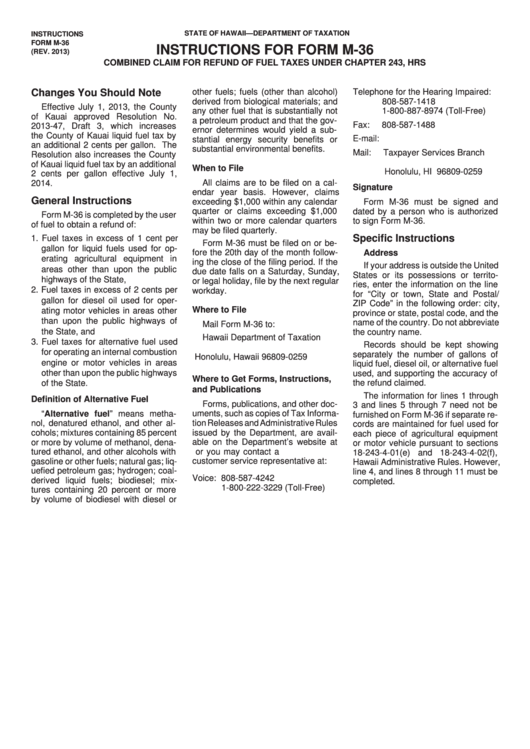

INSTRUCTIONS

STATE OF HAWAII—DEPARTMENT OF TAXATION

FORM M-36

INSTRUCTIONS FOR FORM M-36

(REV. 2013)

COMBINED CLAIM FOR REFUND OF FUEL TAXES UNDER CHAPTER 243, HRS

other fuels; fuels (other than alcohol)

Telephone for the Hearing Impaired:

Changes You Should Note

derived from biological materials; and

808-587-1418

Effective July 1, 2013, the County

any other fuel that is substantially not

1-800-887-8974 (Toll-Free)

of Kauai approved Resolution No.

a petroleum product and that the gov-

Fax:

808-587-1488

2013-47, Draft 3, which increases

ernor determines would yield a sub-

the County of Kauai liquid fuel tax by

E-mail:

stantial energy security benefits or

Taxpayer.Services@hawaii.gov

an additional 2 cents per gallon. The

substantial environmental benefits.

Mail:

Taxpayer Services Branch

Resolution also increases the County

P.O. Box 259

of Kauai liquid fuel tax by an additional

When to File

Honolulu, HI 96809-0259

2 cents per gallon effective July 1,

2014.

All claims are to be filed on a cal-

Signature

endar year basis. However, claims

General Instructions

exceeding $1,000 within any calendar

Form M-36 must be signed and

quarter or claims exceeding $1,000

dated by a person who is authorized

Form M-36 is completed by the user

within two or more calendar quarters

to sign Form M-36.

of fuel to obtain a refund of:

may be filed quarterly.

Specific Instructions

1. Fuel taxes in excess of 1 cent per

Form M-36 must be filed on or be-

gallon for liquid fuels used for op-

fore the 20th day of the month follow-

Address

erating agricultural equipment in

ing the close of the filing period. If the

If your address is outside the United

areas other than upon the public

due date falls on a Saturday, Sunday,

States or its possessions or territo-

highways of the State,

or legal holiday, file by the next regular

ries, enter the information on the line

2. Fuel taxes in excess of 2 cents per

workday.

for “City or town, State and Postal/

gallon for diesel oil used for oper-

ZIP Code” in the following order: city,

Where to File

ating motor vehicles in areas other

province or state, postal code, and the

than upon the public highways of

name of the country. Do not abbreviate

Mail Form M-36 to:

the State, and

the country name.

Hawaii Department of Taxation

3. Fuel taxes for alternative fuel used

Records should be kept showing

P.O. Box 259

for operating an internal combustion

separately the number of gallons of

Honolulu, Hawaii 96809-0259

engine or motor vehicles in areas

liquid fuel, diesel oil, or alternative fuel

other than upon the public highways

used, and supporting the accuracy of

Where to Get Forms, Instructions,

the refund claimed.

of the State.

and Publications

The information for lines 1 through

Definition of Alternative Fuel

Forms, publications, and other doc-

3 and lines 5 through 7 need not be

“Alternative fuel” means metha-

uments, such as copies of Tax Informa-

furnished on Form M-36 if separate re-

nol, denatured ethanol, and other al-

tion Releases and Administrative Rules

cords are maintained for fuel used for

cohols; mixtures containing 85 percent

issued by the Department, are avail-

each piece of agricultural equipment

or more by volume of methanol, dena-

able on the Department’s website at

or motor vehicle pursuant to sections

tured ethanol, and other alcohols with

tax.hawaii.gov or you may contact a

18-243-4-01(e) and 18-243-4-02(f),

gasoline or other fuels; natural gas; liq-

customer service representative at:

Hawaii Administrative Rules. However,

uefied petroleum gas; hydrogen; coal-

line 4, and lines 8 through 11 must be

Voice: 808-587-4242

derived liquid fuels; biodiesel; mix-

completed.

1-800-222-3229 (Toll-Free)

tures containing 20 percent or more

by volume of biodiesel with diesel or

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1