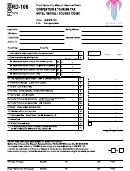

Form Pub. Ks-1540 - Kansas Business Taxes For Hotels Motels & Restaurants Page 19

ADVERTISEMENT

Kansas offers several electronic filing solutions (see

Electronic tax payments must settle on or before

the due date. Using the WebTax system, you can have

chart on page 20). You can use WebTax for on-line

your tax payment electronically debited from your bank

filing and payment for most business tax accounts.

account (ACH Debit). You may choose to initiate your

First, create a user login ID and select a password then

tax payment through your bank (ACH Credit*). Credit

attach your business tax accounts. Each tax account

card payments are also accepted through third-party

has a unique access code that only needs to be

vendors. Visit our web site at for a current

entered once. This access code binds your account to

list of vendors and their services.

your login ID. For future filings, you simply log into your

account using your self-selected user login and

A Form EF-101, Authorization for Electronic Funds Transfer, must be

*

password. A history of all returns filed or payments made

completed for ACH Credit before using the EFT payment method. This

form is available on our web site at:

is retained in WebTax.

WebTax and TeleFile are simple, safe, and FREE

You can also use TeleFile, the telephone option, to

and conveniently available 24 hours a day, 7 days a

file returns and make payments for several tax accounts.

week. You also receive immediate confirmation that your

Like WebTax, you will need your access code to begin.

return is filed.

TeleFile requires that you use this access code each

time you file or make payment.

Refer to your tax type in the table on the following

page to find the electronic filing and payment options

available to you.

Annual Sales and Use Tax zero filers: You may

use your touch-tone telephone to file your annual multi-

jurisdiction tax returns if you are reporting zero sales.

EXAMPLE AND STEPS FOR FILING RETURNS

Like the other telephone application, you will need your

access code to complete your filing.

A hotel and/or restaurant business may be required

to report and remit a number of different taxes

Your access code for our electronic filing systems

administered by KDOR. To illustrate how to accurately

is printed on the sales tax rate change postcard that

report the amount of sales and taxes collected,

annual filers receive each quarter. If you cannot locate

examples and sample completed returns for Kansas

your access code, call our Taxpayer Assistance line at

Retailers’ Sales, Transient Guest, Liquor Drink, and

785-368-8222 and press 5. If you prefer you may email

Consumers’ Compensating Use Taxes and the Dry

your request to: eservices@kdor.ks.gov

Cleaning Environmental Surcharge begin on page 21.

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42