Form Pub. Ks-1540 - Kansas Business Taxes For Hotels Motels & Restaurants Page 25

ADVERTISEMENT

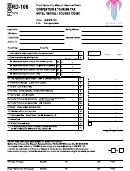

DC-1 (Environmental Surcharge and Solvent Fee). The dry cleaning environmental surcharge is imposed on

the gross receipts received from the sale of dry cleaning or laundering services (in addition to Kansas retailers’ sales

tax). From the example on page 21, Sleep Easy Hotel had gross receipts from the sale of dry cleaning or laundering

services totaling $892.85 (line 1, PART I). The dry cleaning environmental surcharge is due on all gross receipts

except for the sales to exempt entities listed on pages 4 and 5. In this example Sleep Easy Hotel had no exempt sales

of dry cleaning or laundering services (line 2 of the return). The dry cleaning environmental surcharge is 2.5% of the

gross receipts reported on line 3 which computes to $22.32 (lines 4 and 8).

25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42