Total Film Production Credit

production. Do not include in this list any compensation

that you have elected to treat as qualified expenditures.

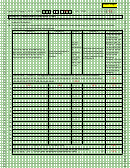

Line 1 – Enter your employment production credit from

Do not include nonresidents who did not perform

Schedule I, Column E, line 19.

services in Montana.

If the production company is a C corporation, sole

If you have more than 16 cast and crew members

proprietorship or limited liability company taxed

participating in the qualified production, you may use

as a C corporation, the election is made by the

additional copies of Schedule I.

production company. If the production company is

Column B – Enter the social security number of each

an S corporation, a partnership, or a limited liability

cast or crew member.

company that elects to be taxed as an S corporation

or partnership, the election is made by each of the

Column C – Before you can claim the cast or crew

shareholders, partners, or members for their share of the

member as a Montana resident, you will need to

credit, and not by the entity.

have the individual complete Montana Form FPC-RD,

Montana Declaration of Residency. You are required to

The election is a one time irrevocable election to

maintain the forms in your company records and provide

treat any unused employment production credit as a

us a copy if requested.

carryforward credit that can be carried forward up to four

succeeding tax years and applied against any further

Column D – Enter the total amount of compensation

tax liabilities or to have it refunded to you upon filing this

that you paid to each Montana resident during your

year’s tax return.

production.

Line 2 – Enter your qualified expenditures credit from

Include the amount of social security wages and taxable

Schedule II, Column D, line 23 on line 2.

benefits that is reported on federal Form W-2. Do not

include amounts paid to independent contractors for

Line 3 – Add the amount on lines 1 and 2 and enter the

contract labor reportable on federal Form 1099-MISC.

result on line 3. This is your combined film production

credit.

Column E – Your employment production credit is

limited to 14% of the first $50,000 of compensation paid

Recapture of previously claimed credits. If the

to each Montana resident. Add the amounts in Column E

Department of Commerce revokes a production

and enter on line 18. Multiply the amount by 0.14 (14%)

company’s state certification, the production company

and enter the result on line 19. Enter the result on Form

is required to refund any amount of the employment

FPC, page 1, line 1. This is your employment production

production or qualified expenditures credit claimed and

credit.

to pay penalties and accrued interest as if the amount

required to be refunded is unpaid tax.

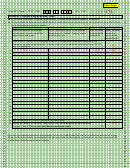

Schedule II Qualified Expenditures Credit

Administrative Rules of Montana: Title 42, Chapter

Column D, Line 1 – Enter on Column D, line 1, the total

4, Subchapter 33

amount of qualified expenditures previously submitted,

and include a copy of your previously submitted Form

Questions? Call us toll free at (866) 859-2254 (in

FPC-PP with the application.

Helena, 444-6900) .

Column A – Enter the name of the business or

individual that you paid. Do not include any expenses

that you previously submitted and reported on line 1.

Refer to page 1 of the instructions for a definition of

qualified expenditures.

Column B – Enter a brief description of the qualified

expenditures (i.e. lumber, lodging, meals, maintenance,

etc.).

Column C – Enter the date you paid the qualified

expenditure.

Column D – Enter the total amount of each qualified

expenditure. Add the amounts in Column D and enter on

line 22. Multiply the amount by 0.09 (9%) and enter the

result on line 23. Enter the result on Form FPC, page 1,

line 2. This is your qualified expenditures credit.

1

1 2

2 3

3 4

4 5

5