1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

Clear Page

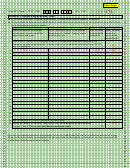

3

3

4

4

110

100

-

-

-

Form FPC, Page 3 - 2014

SSN

OR FEIN

5

X X X X X X X X X

X X X X X X X X X

5

6

6

7

7

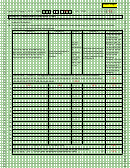

Schedule II, Qualified Expenditures Credit

8

8

► If you have more than 21 qualified expenditures, you may use additional copies of Schedule II.

9

9

► Do not include the expenditures listed below as a deduction when computing your net income for corporation income

10

10

tax or individual income tax purposes.

11

11

Column A

Column B

Column C

Column D

12

12

Enter the name of the business

Enter a brief description of the qualified

Enter the date

Enter the total

13

13

or individual to which a qualified

expenditure (i.e. lumber, lodging, meals,

of the qualified

amount of

14

14

expenditure was made.

maintenance, etc.).

expenditure.

the qualified

15

15

expenditure.

16

16

1. Enter in line 1, column D, the aggregate amount of expenditures previously reported at the

17

17

18

completion of principal photography. Include a copy of your previously submitted Form FPC-PP

18

120

with this application. ....................................................................................................................... 1.

19

19

20

20

130

140

160

150

2.

21

21

3.

22

22

23

23

4.

24

24

5.

25

25

6.

26

26

27

27

7.

28

28

8.

29

29

9.

30

30

31

31

10.

32

32

11.

33

33

34

34

12.

35

35

13.

36

36

14.

37

37

38

38

15.

39

39

16.

40

40

17.

41

41

42

42

18.

43

43

19.

44

44

45

45

20.

46

46

21.

47

47

170

22. Add the amounts in Column D and enter the result here. ............................................................ 22.

48

48

180

49

49

23. Multiply the amount in Column D, line 22 by 0.09 (9%) and enter the result here and

50

50

on page 1, line 2. This is your qualified expenditures credit. .................................................. 23.

51

51

52

52

53

53

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy.

54

54

When you file electronically, you represent that you have retained the required documents in your tax records and will

55

55

provide them upon the department’s request.

56

56

57

57

58

58

59

59

60

60

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5