Form Ct-32-A/b - Combined Group Detail Spreadsheet Attachment To Form Ct-32-A, Banking Corporation Combined Franchise Tax Return - 2014 Page 3

ADVERTISEMENT

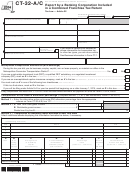

Page 2a CT-32-A/B (2014)

Legal name of parent corporation

Parent EIN

Schedule C – Computation and allocation of alternative ENI

60 ENI from line 57a

...........................................................................................................................................................

(see instructions)

61 Interest income from subsidiary capital from line 45 .............................................................................................................................

62 Dividend income from subsidiary capital from line 46 ...........................................................................................................................

63 Net gain from subsidiary capital from line 47 .........................................................................................................................................

64 Interest income on obligations of New York State, its political subdivisions, and the United States from line 48 ................................

65 Alternative ENI

...................................................................................................................................................

(add lines 60 through 64)

66 Allocated alternative ENI ........................................................................................................................................................................

67 Optional depreciation adjustments from line 58 ....................................................................................................................................

68 Allocated taxable alternative ENI ...........................................................................................................................................................

Schedule D – Computation of taxable assets

(Read instructions before completing this schedule.)

69 Average value of total assets

........................................................................................................................................

(see instructions)

70 Money or other property received from the FDIC, FSLIC, or RTC

................................................................................

(see instructions)

71 Taxable assets

............................................................................................................................................

(subtract line 70 from line 69 )

72 Allocated taxable assets ........................................................................................................................................................................

Net worth on last day of the tax year

73 Compute net worth ratio

:

(see instructions)

=

Total assets on last day of the tax year

.............................................................

Average quarterly balance of mortgages

74 Compute percentage of mortgages

=

included in total assets

:

Average quarterly balance of total assets

.............................................................

(see instructions)

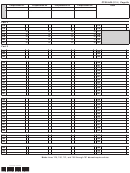

422003140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8