Instructions For Completing Form 11 - Employer'S Municipal Tax Withholding Statement Page 11

ADVERTISEMENT

Workplace City Tax

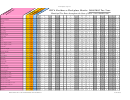

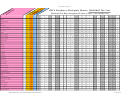

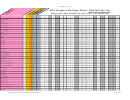

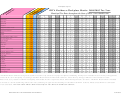

RITA Residence-Workplace Matrix- 2004/2005 Tax Year

Municipal Tax Rates throughout the State of Ohio -

.00

.005 .0075 .01

.012 .0125 .013 .0133 .0135 .014 .015 .016 .0165 .017 .0173 .0175 .018

.02

.021 .0225 .025 .0285

770 .015 .75

.01 .015 .0113 .0094 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075 .0075

South Euclid

769 .01

.00

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

South Solon

776 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0027 .0025 .002

0

0

0

0

Steubenville

775 .01

.00

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

Streetsboro

780 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0025 .002

0

0

0

0

0

Strongsville *(2004 ) 1/1-3/31

780 .02

.75

.02

.02 .0163 .0143 .0125 .0111 .0106 .0102 .01 .0987 .0095 .0088 .008 .0076 .0072 .007 .0069 .0065 .005 .005 .005 .005 .005

Strongsville *(2004) 4/1-

779 .01

.00

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

Sunbury

792 .015 1.00 .015 .015

.01 .0075 .005 .003 .0025 .002 .0017 .0015 .001

0

0

0

0

0

0

0

0

0

0

0

0

Toronto

800 .015 .50

.01 .015 .0125 .0113 .01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

University Heights *(2004) 1/1-9/30

800 .015 .00

.01 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015 .015

University Heights *10/1-

802 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0025 .002

0

0

0

0

0

Upper Arlington

806 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0025 .002

0

0

0

0

0

Urbancrest

810 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0025 .002

0

0

0

0

0

Valley View

815 .01 1.00 .01

.01

.005 .0025

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Vermilion

821 .01

.50

.01

.01 .0075 .0063 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005

Wakeman *(2004)1/1-2/29

821 .00

.00

.00

.00

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Wakeman *(2004) 3/1-4/30

821 .01

.50

.01

.01 .0075 .0063 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005 .005

Wakeman *(2004) 5/1-

820 .02 1.00 .02

.02

.005 .0025

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Walton Hills

834 .0075 1.00 .0075 .0075 .0025

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Wellston

839 .01

.00

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

.01

Wellsville

840 .015 1.00 .015 .015

.01 .0075 .005 .003 .0025 .002 .0017 .0015 .001

0

0

0

0

0

0

0

0

0

0

0

0

Westlake

890 .02 .875 .02

.02 .0156 .0134 .0113 .0095 .0091 .0086 .0083 .0082 .0077 .0069 .006 .0055 .0051 .0048 .0047 .0043 .0025 .0025 .0025 .0025 .0025

Willowick

894 .01 1.00 .01

.01

.005 .0025

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

Wintersville

900 .02

.75

.01

.02 .0163 .0143 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125 .0125

Woodmere

904 .02 1.00 .02

.02

.015 .0125 .01

.008 .0075 .007 .0067 .0065 .006 .005 .004 .0035 .003 .0027 .0025 .002

0

0

0

0

0

Worthington *(2004)

906 .015 1.00 .015 .015

.01 .0075 .005 .003 .0025 .002 .0017 .0015 .001

0

0

0

0

0

0

0

0

0

0

0

0

Yellow Springs

*The RITA Matrix Chart was designed to determine residence city tax based on proper workplace withholding. Example: an individual lives in the City of Pepper Pike

and works in a .01 municipality. According to the RITA Matrix Chart the individual would owe .005 to the City of Pepper Pike due to the reduced tax credit.

Please note, every resident of a RITA municipality with taxable income is required to file an annual municipal income tax return. This RITA Matrix Chart is intended

to be used as a tool in determining effective tax rates, estimating tax payments and checking tax calculations for RITA residents. Please contact RITA for verification

of tax calculation. PLEASE NOTE THIS CHART IS SUBJECT TO CHANGE WITHOUT NOTICE.

PREPARED BY THE MARKETING DEPARTMENT

2/24/2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12