Instructions For Completing Form 11 - Employer'S Municipal Tax Withholding Statement Page 6

ADVERTISEMENT

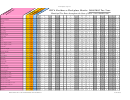

2004 WITHHOLDING TAX TABLE

CODE

MUNICIPALITY

RATE

CODE

MUNICIPALITY

RATE

013

ARLINGTON HEIGHTS

2.10

520

MORELAND HILLS

1.00

006

ASHVILLE

0.50

528

MOUNT STERLING

1.00

010

AURORA

2.00

535

NEW ALBANY

2.00

020

AVON

1.50

504

NEW BLOOMINGTON

1.00

021

AVON LAKE

1.50

540

NEWBURGH HEIGHTS

2.00

040

BAY VILLAGE

1.50

561

NEWTOWN

1.00

050

BEACHWOOD

1.50

549

NORTH LEWISBURG

1.00

051

BEACHWOOD EAST JEDD

1.50

550

NORTH OLMSTED

2.00

052

BEACHWOOD WEST JEDD

1.50

570

NORTH ROYALTON

1.00

065

BEDFORD HEIGHTS

2.00

580

OAKWOOD VILLAGE

2.00

090

BENTLEYVILLE

1.00

585

OBERLIN

1.90

100

BEREA

2.00

590

OLMSTED FALLS

1.50

104

BEXLEY

2.00

589

OLMSTED JEDD

1.50

110

BOSTON HEIGHTS

1.50

600

ORANGE VILLAGE

2.00

115

BRADY LAKE

1.00

601

ORANGE-CHAGRIN-

HIGHLANDS JEDD

130

BRECKSVILLE

2.00

2.00

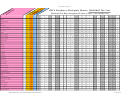

140

BROADVIEW HEIGHTS

2.00

606

OTTAWA

1.00

160

BROOKLYN HEIGHTS

2.00

650

PEPPER PIKE

1.00

195

* CECIL

1.00

640

PLAIN CITY

1.00

192

CEDARVILLE

1.00

635

PLYMOUTH

0.50

194

CENTERBURG

1.00

648

POWELL

0.75

180

CHAGRIN FALLS

1.50

660

REMINDERVILLE

1.50

190

CIRCLEVILLE

1.50

661

REMINDERVILLE /

193

* CLAYTON

1.50

TWINSBURG TOWNSHIP JEDD

1.50

250

CUYAHOGA HEIGHTS

2.00

662

REYNOLDSBURG

1.50

270

EAST CLEVELAND

2.00

670

RICHMOND HEIGHTS

2.00

277

ELYRIA

1.75

671

* RICHWOOD

1.00

282

ELYRIA TOWNSHIP /

669

RIDGEWAY

0.50

CITY OF ELYRIA JEDD

1.75

680

RIVERSIDE

1.50

291

FAIRPORT HARBOR

2.00

704

* SABINA

0.50

300

FAIRVIEW PARK

1.50

707

SAINT PARIS

1.00

304

FORT JENNINGS

1.00

712

SALINEVILLE

1.00

319

GALENA

1.00

710

SANDUSKY

1.00

320

GARFIELD HEIGHTS

2.00

720

SEVEN HILLS

2.00

347

GLENWILLOW

2.00

750

SHAKER HEIGHTS

1.75

357

GRANDVIEW HEIGHTS

2.00

749

SHAWNEE HILLS

2.00

358

* GROVE CITY

2.00

751

SHEFFIELD LAKE

1.25

364

* HASKINS

1.00

752

SHEFFIELD VILLAGE

1.50

370

HIGHLAND HEIGHTS

1.50

748

* SHERWOOD

1.00

378

HUDSON

1.00

756

SILVER LAKE

2.00

390

INDEPENDENCE

2.00

770

SOUTH EUCLID

1.50

394

KIRTLAND

2.00

769

SOUTH SOLON

1.00

398

LAGRANGE

1.50

776

STEUBENVILLE

2.00

401

LAKEMORE

2.00

775

STREETSBORO

1.00

400

LAKEWOOD

1.50

780

STRONGSVILLE

2.00

426

LOCKLAND

2.10

779

SUNBURY

1.00

440

LYNDHURST

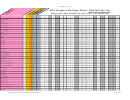

1.50

792

TORONTO

1.50

450

* MACEDONIA

2.00

800

UNIVERSITY HEIGHTS

1.50

451

* MACEDONIA / NORTHFIELD

802

UPPER ARLINGTON

2.00

CENTER TWP. JEDD

2.00

806

URBANCREST

2.00

454

MAINEVILLE

1.00

810

VALLEY VIEW

2.00

460

MAPLE HEIGHTS

2.00

815

VERMILION

1.00

466

MARTINS FERRY

0.75

821

WAKEMAN

1.00

467

MARYSVILLE

1.00

820

WALTON HILLS

2.00

480

MAYFIELD HEIGHTS

1.00

834

WELLSTON

0.75

485

MAYFIELD VILLAGE

1.50

839

* WELLSVILLE

1.00

500

MIDDLEBURG HEIGHTS

1.75

840

WESTLAKE

1.50

505

MILAN

0.50

890

WILLOWICK

2.00

507

MILFORD CENTER

1.00

894

WINTERSVILLE

1.00

515

MOGADORE

2.00

900

WOODMERE

2.00

904

* WORTHINGTON

2.00

906

YELLOW SPRINGS

1.50

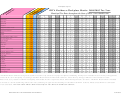

*CECIL NEW MEMBER & NEW TAX AS OF 1-1-04

*RICHWOOD TAX RATE CHANGE FROM

*CLAYTON NEW MEMBER & NEW TAX AS OF 1-1-04

0.50% TO 1.00% AS OF 1-1-04

*GROVE CITY NEW MEMBER AS OF 7-1-04

*SABINA NEW MEMBER & NEW TAX AS OF 5-27-04

*HASKINS NEW MEMBER AS OF 1-1-04

*SHERWOOD NEW MEMBER & NEW TAX AS OF 7-1-04

*MACEDONIA NEW MEMBER AS OF 10-1-04

*WELLSVILLE NEW MEMBER AS OF 2-1-04

*MACEDONIA / NORTHFIELD CENTER TWP JEDD

*WORTHINGTON TAX RATE CHANGE FROM

NEW MEMBER AS OF 10-1-04

1.65% TO 2.00% AS OF 1-1-04

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12