Instructions For Completing Form 11 - Employer'S Municipal Tax Withholding Statement Page 12

ADVERTISEMENT

Workplace City Tax

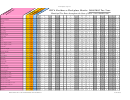

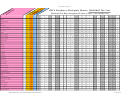

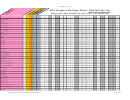

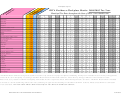

RITA Residence-Workplace Matrix- 2004/2005 Tax Year

Municipal Tax Rates throughout the State of Ohio -

.00

.005 .0075 .01

.012 .0125 .013 .0133 .0135 .014 .015 .016 .0165 .017 .0173 .0175 .018

.02

.021 .0225 .025 .0285

*Municipal Notes:

1. Boston Heights - 2005 Tax Rate and Credit Limit change from .015 to .02 effective 1-1-2005

2. Cecil - 2004 Introduced a New Tax Rate of .01 with .50 Tax Credit effective 1-1-2004

3. Clayton - 2004 Introduced a New Tax Rate of .015 with 1.00 Tax Credit effective 1-1-2004

4. Elyria - 2004 Tax Credit Change from 1.00 to .50 effective 7-1-2004

Elyria - 2005 Tax Credit Change from .50 to 1.00 effective 1-1-2005

5. Fairview Park - 2005 Tax Rate change from .015 to .02 effective 4-1-2005

6. Hudson - 2005 Tax Rate and Credit Limit change from .01 to .02 effective 1-1-2005

7. Minerva Park - 2005 Introduced a New Tax Rate of .01 with .50 Tax Credit effective 1-1-2005

8. Richwood - 2004 Tax Rate change from .005 to .01 and Tax Credit change from .25 to .00 effective 1-1-2004

9. Sabina - 2004 Introduced a New Tax Rate of .005 with 0.00 Tax Credit effective 5-27-2004

Sabina - 2005 Tax Rate change from .005 to .01 and Tax Credit change from .00 to 1.00 effective 1-1-2005

10. Sherwood - 2004 Introduced a New Tax Rate of .01 with 1.00 Tax Credit effective 7-1-2004

11. Strongsville - 2004 Tax Credit change from 1.00 to .75 effective 4-1-2004

12. University Heights - 2004 Tax Credit change from .50 to .00 effective 10-1-2004

13. Wakeman - 2004 Tax expired 2-29-2004; reinstated 5-1-2004

14. Worthington - 2004 Tax Rate and Credit Limit change from .0165 to .02 effective 1-1- 2004

PREPARED BY THE MARKETING DEPARTMENT

2/24/2005

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12