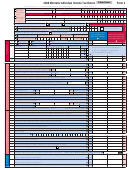

Form 2, Page 5 – 2013

Social Security Number:

Schedule II – Montana Subtractions from Federal Adjusted Gross Income

Column A (for single,

Column B (for spouse

Enter your subtractions from federal adjusted gross income on the corresponding line.

joint, separate, or head

when fi ling separately

File Schedule II with your Montana Form 2.

of household)

using fi ling status 3a)

1 Exempt interest and mutual fund dividends from federal bonds, notes and obligations ................................

1

00

00

15-30-2110(2)(a)

42.15.216

2 Exempt tribal income. Include Form ETM .....................................................................................................

2

00

00

15-30-2110(2)(a)

42.15.220

3 Exempt unemployment compensation ..........................................................................................................

3

00

00

15-30-2101(10)

4 Exempt workers’ compensation benefi ts .......................................................................................................

4

00

00

15-30-2110(2)(g)

5 Exempt capital gains and dividends from small business investment companies .........................................

5

00

00

15-33-106

42.23.108-110

6 State income tax refunds included on Form 2, line 10 ..................................................................................

6

00

00

15-30-2110(2)(d)

7 Recoveries of amounts deducted in earlier years that did not reduce Montana income tax .........................

7

00

00

15-30-2110(2)(m)

8 Exempt military salary of residents on active duty .........................................................................................

8

00

00

15-30-2117

42.15.214

9 Exempt income of nonresident military servicepersons ................................................................................

9

15-30-2101(18)(b)(i)

00

42.15.112

00

10 Exempt life insurance premiums reimbursement for National Guard and Reservist .....................................

10

00

00

15-30-2117(3)

11 Partial pension and annuity income exemption. Report Tier II Railroad Retirement on

42.15.219

15-30-2110(2)(c)

line 23 below. Complete Worksheet IV ..........................................................................................................

11

00

00

42.15.222

12 Partial interest exemption for taxpayers 65 and older ...................................................................................

12

00

00

15-30-2110(2)(b)

42.15.215

13 Partial retirement disability income exemption for taxpayers under age 65. Include Form DS-1 ..................

13

00

00

15-30-2110(10)

42.15.217

14 Exemption for certain taxed tips and gratuities ..............................................................................................

14

00

00

15-30-2110(2)(f)

15 Exemption for certain income of child taxed to parent ...................................................................................

15

00

00

15-30-2110(2)(p)

42.15.221

16 Exemption for certain health insurance premiums taxed to employee ..........................................................

16

15-30-2110(2)(h)

00

00

17 Exemption for student loan repayments taxed to health care professional ...................................................

17

00

00

15-30-2110(12)

18 Exempt medical care savings account deposits and earnings. Include Form MSA ......................................

18

15-61-202

15-30-2110(2)(j)

00

42.15.602

00

19 Exempt fi rst-time home buyer savings account deposits and earnings. Include Form FTB ..........................

19

00

00

15-63-202

15-30-2110(2)(k)

42.15.906

withdrawal

20 Exempt family education savings account deposits ......................................................................................

20

15-62-207

15-30-2110(11)

00

42.15.802

00

15-30-2110(2)(l)

21 Exempt farm and ranch risk management account deposits. Include Form FRM .........................................

21

00

00

15-30-2110(2)(o)

22 Subtraction from federal taxable social security benefi ts/Tier I Railroad Retirement reported on

MFS 15-30-2110(5)

15-30-2110(2)(c)

42.15.222

Form 2, line 20b. Complete Worksheet VIII ..................................................................................................

22

00

00

23 Subtraction for federal taxable Tier II Railroad Retirement benefi ts reported on Form 2, line 16b ................

23

42.15.222

00

00

24 Passive loss adjustment ................................................................................................................................

24

MFS 15-30-2110(7)

00

42.15.206(2)(b)

00

25 Capital loss adjustment .................................................................................................................................

25

00

00

MFS 15-30-2110(6)

42.15.206(2)(a)

26 Subtraction of sole proprietor for allocation of compensation to spouse .......................................................

26

00

00

42.15.322(5)

NOL Refund Int

27 Montana net operating loss carryover from Montana Form NOL, Schedule B ..............................................

27

15-30-2609(4)(a)(ii)

00

00

15-30-2119

42.15.318

28 40% capital gain exclusion for pre-1987 installment sales. Complete Worksheet III ....................................

28

15-30-2110(13)

00

42.15.218

00

29 Subtraction for business-related expenses for purchasing recycled material. Include Form RCYL ..............

29

00

00

15-32-609

42.4.2602

30 Subtraction for sales of land to beginning farmers ........................................................................................

30

80-12-211

00

42.15.415

00

31 Subtraction for larger federal estate and trust taxable distribution ................................................................

31

00

00

15-30-2110(2)(n)

32 Subtraction for wage deduction reduced by federal targeted jobs credit .......................................................

32

00

00

15-30-2110(4)

33 Subtraction for certain gains recognized by liquidating corporation ..............................................................

33

15-30-2110(2)(e)

00

00

34 Other subtractions.

Specify:

34

00

00

mobile home park 15-30-2110(2)(s)

35 Add lines 1 through 34. Enter the total here and on Form 2, line 40. This is your total Montana

organic and inorganic fertilizer

subtractions from federal adjusted gross income. ..................................................................................

35

00

00

15-32-301

*13CE0588*

*13CE0588*

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10