In general-same as IRC

according to

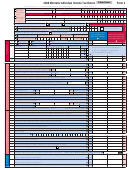

Form 2, Page 6 – 2013

Social Security Number:

15-30-2131(1)(a)

Schedule III – Montana Itemized Deductions

Column A (for single,

Column B (for spouse

Enter your itemized deductions on the corresponding line.

joint, separate, or head

when fi ling separately

File Schedule III with your Montana Form 2.

of household)

using fi ling status 3a)

1 Medical and dental expenses ..................................... 1

00

00

In general-same as IRC according to

Married Filing Separate 42.15.524

15-30-2131(1)(a)

2 Enter the amount from Form 2, line 41 ....................... 2

00

00

42.15.525

3 Multiply line 2 by 10% (0.10). But if you were born

before January 2, 1949, multiply line 2 by 7.5%

(0.075) instead (see instructions ) ............................... 3

00

00

4 Subtract line 3 from line 1 and enter the result here, but not less than zero. This is your deductible

medical and dental expense subject to a percentage of Montana Adjusted Gross Income ....................

4

00

00

5 Medical insurance premiums not deducted elsewhere on your return ..............................................................

5

00

00

15-30-2131(1)(a)(iii)&(g)(i)

6 Long-term care insurance premiums not deducted elsewhere on your return ..................................................

6

15-30-2131(1)(a)(iv)&(g)(ii)

00

00

Complete lines 7a through 7d reporting your total federal income tax payments made in 2013 before completing line 7e. You cannot deduct your self-employment

taxes paid on lines 7a through 7d.

7a Federal income tax withheld in 2013 .......................... 7a

00

00

7b Federal estimated tax payments paid in 2013 ............ 7b

00

00

7c 2012 federal income taxes paid in 2013 ..................... 7c

00

00

7d Other back year federal income taxes paid in 2013.

Include federal Form 1040 or 1040A .......................... 7d

00

00

7e Add lines 7a through 7d and enter the result here, but not more than $5,000 if you are fi ling single, head

of household, or married fi ling separately; or $10,000 if fi ling a joint return with your spouse. This is your

15-30-2131(1)(b)

federal income tax deduction. ........................................................................................................................ 7e

00

00

8 General state and local sales taxes paid in 2013 (see instructions ) ..................................................................

8

00

00

9 Local income taxes paid in 2013 (see instructions ) ...........................................................................................

9

00

00

10 Real estate taxes paid in 2013 .......................................................................................................................... 10

00

00

11 Personal property taxes paid in 2013 (see instructions ) .................................................................................... 11

00

00

Light vehicle registration fees

15-30-2131(1)(h)

12 Other deductible taxes paid in 2013. List type and amount:

12

00

00

13 Home mortgage interest and points. If paid to the person from whom you bought the house, provide their

name, social security number, and address.

13

00

00

14 Qualifi ed mortgage insurance premiums (see instructions ) .............................................................................. 14

00

00

15 Investment interest. Include federal Form 4952 ................................................................................................ 15

00

00

16 Charitable contributions made by cash or check during 2013 ........................................................................... 16

00

00

15-30-2131(1)(a)(v)

Child abuse check-off

15-30-2131(1)(f)

17 Charitable contributions made by other than cash or check during 2013 .......................................................... 17

00

00

18 Charitable contribution carryover from the prior year ........................................................................................ 18

00

00

19 Child and dependent care expenses. Include Montana Form 2441-M .............................................................. 19

00

00

42.15.427

15-30-2131(1)(c)(i)

20 Casualty or theft loss(es). Include federal Form 4684 ....................................................................................... 20

00

00

21 Unreimbursed employee business expenses. Include

federal Form 2106 or 2106-EZ ................................... 21

00

00

22 Other expenses. List type and amount:

22

00

00

23 Add lines 21 and 22 .................................................... 23

00

00

24 Enter the amount from Form 2, line 41 ....................... 24

00

00

25 Multiply line 24 by 2% (0.02) ...................................... 25

00

42.15.525

00

26 Subtract line 25 from line 23 and enter the result here, but not less than zero ................................................. 26

00

00

27 Political contributions (limited to $100 per taxpayer) ......................................................................................... 27

00

00

15-30-2131(1)(d)

28 Other miscellaneous deductions not subject to 2% of Montana AGI. List type and amount:

28

organic or inorganic fertilizer

per capita livestock fees

organic or inorganic fertilizer

00

00

15-30-2131(1)(e)

15-30-2131(1)(i)

15-32-303

29 Gambling losses allowed under federal law ...................................................................................................... 29

00

00

30 Is the amount on Form 2, line 41 more than $300,000 if fi ling jointly, $275,000 if fi ling head of household,

$250,000 if fi ling single or $150,000 if married fi ling separately? If yes, mark this box

and complete

Worksheet VI-IDL. Otherwise, add lines 4 through 6, 7e through 20; and 26 through 29 and enter result

here and on Form 2, line 42. This is your total itemized deductions. .......................................................... 30

00

00

*13CE0688*

*13CE0688*

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10