Form 2, Page 9 – 2013

Social Security Number:

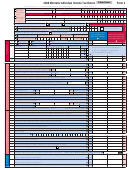

Schedule VI – Credit for an Income Tax Liability Paid to Another State or Country

Column A (for single,

Column B (for spouse

Full-year Resident Only

joint, separate, or head

when fi ling separately

File Schedule VI with your Montana Form 2.

of household)

using fi ling status 3a)

1 Enter your income taxable to another state or country that is included in Montana adjusted gross income

on Form 2, line 41 ..........................................................................................................................................

1

00

00

2 Enter your total income from the other state or country you used in calculating your income tax paid to

that state or country. This includes the income from line 1 plus all income exempt from Montana income

tax that was subject to tax in the other state or country. Indicate state’s abbreviation.

2

00

00

3 Enter your total Montana adjusted gross income from Form 2, line 41 .........................................................

3

00

00

4 Enter your total income tax liability paid to the other state or country ...........................................................

4

00

00

5 Enter your Montana tax liability from Form 2, line 48 ....................................................................................

5

00

00

6 Divide line 1 by line 2. Enter the percentage here, but not more than 100% ................................................

6

%

%

.

.

7 Multiply line 4 by line 6 and enter the result here ..........................................................................................

7

00

00

8 Divide line 1 by line 3. Enter the percentage here, but not more than 100% ................................................

8

%

%

.

.

9 Multiply line 5 by line 8 and enter the result here ..........................................................................................

9

00

00

10 Enter here and on Form 2, Schedule V, line 1 the smaller of the amounts reported on lines 4, 7 or 9

above. This is your credit for an income tax paid to another state or country. .....................................

10

00

00

Schedule VII – Credit for an Income Tax Liability Paid to Another State or Country

Column A (for single,

Column B (for spouse

Part-year Resident Only

joint, separate, or head

when fi ling separately

File Schedule VII with your Montana Form 2.

of household)

using fi ling status 3a)

1 Enter your income taxable to another state or country that is included in Montana source income on

Form 2, Schedule IV, line 16, total Montana source income .........................................................................

1

00

00

2 Enter your total income from the other state or country you used in calculating your income tax paid to

that state or country. This includes the income from line 1 plus all income exempt from Montana income

tax that was subject to tax in the other state or country. Indicate state’s abbreviation.

2

00

00

3 Enter your total Montana source income from Form 2, Schedule IV, line 16.................................................

3

00

00

4 Enter your total income tax liability paid to the other state or country ...........................................................

4

00

00

5 Enter your Montana tax liability from Form 2, line 48a ..................................................................................

5

00

00

6 Divide line 1 by line 2. Enter the percentage here, but not more than 100% ................................................

6

%

%

.

.

7 Multiply line 4 by line 6 and enter the result here ..........................................................................................

7

00

00

8 Divide line 1 by line 3. Enter the percentage here, but not more than 100% ................................................

8

%

%

.

.

9 Multiply line 5 by line 8 and enter the result here ..........................................................................................

9

00

00

10 Enter here and on Form 2, Schedule V, line 1 the smaller of the amounts reported on lines 4, 7 or 9

above. This is your credit for an income tax paid to another state or country. .....................................

10

00

00

• You are not entitled to a Montana tax credit for taxes paid to a foreign country to the extent you claimed these taxes as a foreign tax credit on your federal

income tax return.

• If you claim this credit for an income tax paid by your S corporation or partnership, see the instructions for Form 2, Schedule V, line 1 .

• Your credit is limited to a tax liability paid on income that is also taxed by Montana.

• Your income tax paid includes your share of any excise or franchise taxes paid by your S corporation or partnership if they are imposed on the entity itself and

measured by the entity’s net income.

• This is a nonrefundable credit and cannot reduce your Montana tax liability below zero.

• This is a nonrefundable single-year credit. No unused credit amount can be carried forward.

• You will need to complete a separate Schedule VI or VII for each state or country to which you have paid an income tax liability. You cannot combine payments

on one schedule.

• If you are a part-year resident, you will need to allocate your income on Form 2, Schedule IV before completing Form 2, Schedule VII.

*13CE0988*

*13CE0988*

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10