has elected unitary apportionment. The denominator of the

To achieve proper apportionment, a subtraction is permitted

combined sales factor must include the total sales everywhere

for the non-unitary source income on line 8 of Form 4918. On

of the flow-through entities for which the individual member

that form, income received as a distributive share from a source

has

elected

unitary

apportionment.

The

flow-through

flow-through entity is subtracted prior to apportionment of the

filer’s own tentative distributive income and added back to the

entity withholding on this individual will use the combined

total after application of the filer’s apportionment factor. This

apportionment factor to apportion the distributive share of

business income attributable to that individual.

subtraction preserves the source entity’s sales apportionment

as applied to the distributive share income received by the filer

Sales

from the source entity.

When calculating the sales factor for members that are C

Line 1a: For a flow-through entity that is unitary with a

Corporations or intermediate flow through entities, sale or

CIT taxpayer: Enter on this line the combined Michigan

sales shall have the same meaning as those terms under the

sales of the flow-through entity that is filing this form, the CIT

CIT.

taxpayer that is unitary with the flow-through entity, and all

other flow-through entities that are also unitary with the CIT

When calculating the sales factor for members that are

taxpayer and the flow-through filing this form. The Michigan

individuals, sale or sales means all gross receipts of the

taxpayer not allocated under the Individual Income Tax

sales used when calculating the unitary sales factor for a CIT

taxpayer that is unitary with the flow-through entity includes

sections MCL 206.110 through MCL 206.114. Sale or sales

includes gross receipts from sales of tangible property, rental

all of the sales of the CIT taxpayer that are sourced to Michigan

and a proportionate amount of the flow-through entity’s sales

of property, and providing of services that constitute business

activity. Exclude all receipts from non-business income. For

that have been sourced to Michigan. This can be calculated

more information on what is a “sale” for either purpose see

using the equation for the numerator included above in the

the instructions for the Annual Flow-Through Withholding

General Instructions.

Reconciliation Return (Form 4918).

For a flow-through entity that withholds on an individual

who will report income using combined apportionment for

line by line Instructions

unitary flow-through entities: Enter on this line the combined

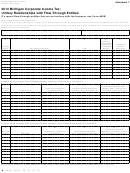

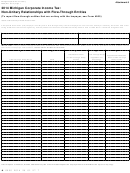

Name and FEIN: On the first line, enter the name and Federal

Michigan sales of the flow-through entities for which the

Employer Identification Number (FEIN) of the flow-through

individual member has elected unitary apportionment.

entity that is completing this form.

Line 1b: For a flow-through entity that is unitary with a CIT

taxpayer: Enter on this line the combined total sales of the flow-

On the second line enter the name and FEIN of the CIT

taxpayer that is unitary with the flow-through entity that is

through entity that is filing this form, the CIT taxpayer that is

filing this form.

unitary with the flow-through entity, and all other flow-through

entities that are also unitary with the CIT taxpayer and the flow-

Part 1: Apportionment Percentages

through filing this form. The total sales used when calculating

Use this part to calculate either the combined sales factor to

the unitary sales factor for a CIT taxpayer that is unitary with

be used to apportion the distributive share of income received

the flow-through entity includes all of the sales of the CIT

by a CIT taxpayer that is unitary with the flow-through entity,

taxpayer and a proportionate amount of the flow-through entity’s

OR, the combined sales factor to be used to apportion the

total sales. This can be calculated using the equation for the

distributive share of income received by an individual who will

denominator included above in the General Instructions.

report income using combined apportionment for unitary flow-

For a flow-through entity that withholds on individual

through entities. If the flow-through entity filing this form must

who will report income using combined apportionment for

calculate a combined sales factor for both CIT and individual

unitary flow-through entities: Enter on this line the combined

purposes, file more than one 4919. If the filer must calculate a

total sales everywhere of the flow-through entities for which

combined sales factor for more than one corporate member,

the individual member has elected unitary apportionment.

or more than one individual who will report income using

combined apportionment for unitary flow through entities, file

Line 2a: For a flow-through entity withholding on a C

one 4919 per each such member. Do not blend the sales factors.

Corporation or other flow-through entity member: Enter

the Michigan sales that are attributable to the flow-through

Note for Tiered Structures

entity. Do not include any sales that are attributable to the flow-

For CIT withholding: If the flow-through entity filing this

through entity’s members.

form (intermediate) earns income as a distributive share from

another flow-through entity (source) that is not unitary with the

For a flow-through entity withholding on an individual: Enter

the Michigan sales, as defined for members that are individuals,

intermediate and a C Corporation member, that income will be

that are attributable to the flow-through entity. Include on this

apportioned according to the source entity’s sales factor.

line any “throwback sales” of the flow-through entity.

For Individual Withholding: If the flow-through entity filing

Line 2b: For a flow-through entity withholding on a C

this form earns income as a distributive share from another

flow-through entity (source) that is not applying the same

Corporation or other flow-through entity member: Enter the

combined apportionment factor used by the filer, that source

total sales that are attributable to the flow-through entity. Do

not include any sales that are attributable to the flow-through

income will be apportioned according to the source entity’s

sales factor.

entity’s members.

26

1

1 2

2 3

3 4

4