For a flow-through entity withholding on an individual:

For a flow-through entity that withholds on an individual

Enter the total sales everywhere, as defined for members

who will report income using combined apportionment

that are individuals, that are attributable to the flow-through

for unitary flow-through entities: Add line 4a and line 4b

entity.

and subtract the entire amount of personal exemption claimed

on individuals. Enter the result of this calculation on line

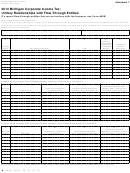

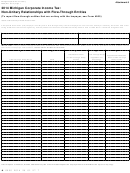

Part 2: Distributive Business Income

5 and carry this amount to line 14B of Form 4918. For more

Use this part to calculate apportioned distributive income. If

information on personal exemption, see the instructions for

the flow-through entity filing this form must calculate the sales

Form 4918, line 12B.

factor for both CIT and individual purposes, file more than

Include completed Form 4919 as part of the tax return filing.

one 4919. Do not blend the sales factors. Do not combine the

calculations in this part.

To the extent a 4919 is calculated for CIT purposes, the results

will be carried to Form 4918, Column A, as directed below.

To the extent a 4919 is calculated for individual purposes, the

results will be carried to Form 4918, Column B, as directed

below. Do not combine the calculations in this part.

Line 3a: For a flow-through entity that is unitary with a

CIT taxpayer: Enter on this line the distributive share of the

flow-through entity’s business income that is attributable to

the CIT taxpayer that is unitary with the flow-through entity or

attributable to a flow-through entity that is unitary with a CIT

taxpayer and the flow-through entity filing this return. The

amount entered on this line combined with the amount entered

on line 3b must equal the amount entered on line 9A of Form

4918.

For a flow-through entity that withholds on an individual

who will report income using combined apportionment

for unitary flow-through entities: Enter on this line the

distributive share of the flow-through entity’s business income

that is attributable to the individual who will report income

using combined apportionment for unitary flow-through

entities. The amount entered on this line combined with the

amount entered on line 3b must equal the amount entered on

line 9B of Form 4918.

Line 3b: For a flow-through entity that is unitary with a

CIT taxpayer: Enter on this line the distributive share of the

flow-through entity’s business income, that is attributable to

members that are C Corporations or other flow-through entities

that are not unitary with the flow-through entity filing this

return. The amount entered on this line combined with the

amount entered on line 3a must equal the amount entered on

line 9A of Form 4918.

For a flow-through entity that withholds on an individual

who will report income using combined apportionment

for unitary flow-through entities: Enter on this line the

distributive share of the flow-through entity’s business income

that is not entered on line 3a. The amount entered on this line

combined with the amount entered on line 3a must equal the

amount entered on line 9B of Form 4918.

Line 4a: Multiply line 3a by line 1c and enter that amount on

this line.

Line 4b: Multiply line 3b by line 2c and enter that amount on

this line.

Line 5: For a flow-through entity that is unitary with a CIT

taxpayer: Add line 4a and line 4b. Enter this amount on this

line and carry this amount to line 14A of Form 4918.

27

1

1 2

2 3

3 4

4