Form Ct-3-A/b - Subsidiary Detail Spreadsheet - Attachment To Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2014 Page 3

ADVERTISEMENT

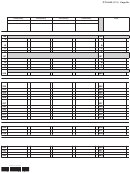

Page 2a CT-3-A/B (2014)

Legal name of the parent of the combined group

EIN

Subsidiary

Subsidiary

EIN

EIN

Legal name of corporation

Legal name of corporation

Combined minimum taxable income (MTI) base

(see instructions)

Adjustments

(see instructions for lines 43 through 50)

43 Depreciation of tangible property placed in service after 1986 .........

43

44 Amortization of mining exploration and development costs paid or

incurred after 1986 ..........................................................................

44

45 Amortization of circulation expenditures paid or incurred after 1986

.......................................................

45

(personal holding companies only)

46 Basis adjustments in determining gain or loss from sale or exchange

46

of property .......................................................................................

47 Long-term contracts entered into after February 28, 1986 ................

47

48 Installment sales of certain property ...................................................

48

49 Merchant marine capital construction funds ......................................

49

50 Passive activity loss

50

(closely held and personal service corporations only)

Tax preference items

52 Depletion

....................................................................

52

(see instructions)

53

54 Intangible drilling costs

..............................................

54

(see instructions)

Combined business allocation percentage for aviation corporations

(see instructions)

118a New York aircraft arrivals and departures (revenue flights only)

118a

(see instr.)

118b Adjusted New York aircraft arrivals and departures (revenue flights

118b

only)

(multiply line 118a by 60% (.6)) ...........................................................

119 Total aircraft arrivals and departures (revenue flights only)

119

(see instr.)

121a New York revenue tons handled

................................ 121a

(see instructions)

121b Adjusted New York revenue tons handled

121b

(multiply line 121a by 60% (.6))

122 Total revenue tons handled

........................................ 122a

(see instructions)

124a New York originating revenue

.................................... 124a

(see instructions)

124b Adjusted New York originating revenue

... 124b

(multiply line 124a by 60% (.6))

125 Total originating revenue

............................................

125

(see instructions)

436003140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10