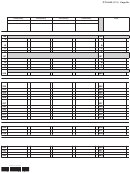

Form Ct-3-A/b - Subsidiary Detail Spreadsheet - Attachment To Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2014 Page 5

ADVERTISEMENT

Page 3a CT-3-A/B (2014)

Legal name of the parent of the combined group

EIN

Subsidiary

Subsidiary

EIN

EIN

Legal name of corporation

Legal name of corporation

Combined business allocation percentage

Average value of property

(see instructions)

129 New York real estate owned ................................................................

129

130 Total real estate owned ........................................................................

130

131 New York real estate rented .................................................................

131

132 Total real estate rented .........................................................................

132

133 New York inventories owned................................................................

133

134 Total inventories owned .......................................................................

134

135 New York tangible personal property owned .....................................................

135

136 Total tangible personal property owned...............................................

136

137 New York tangible personal property rented .......................................

137

138 Total tangible personal property rented ...............................................

138

139 Total New York property

139

..............

(add lines 129, 131, 133, 135, and 137)

140 Total property everywhere

140

...........

(add lines 130, 132, 134, 136, and 138)

Receipts in the regular course of business from

:

(see instructions)

142 Sales of tangible personal property allocated to New York State

142

(see instr.)

143 Total sales of tangible personal property

143

....................

(see instructions)

144 New York services performed

.....................................

144

(see instructions)

145 Total services performed

.............................................

145

(see instructions)

146 New York rentals of property

146

......................................

(see instructions)

147 Total rentals of property

..............................................

147

(see instructions)

148 New York royalties

......................................................

148

(see instructions)

149 Total royalties

149

..............................................................

(see instructions)

150 Other New York business receipts

150

..............................

(see instructions)

151 Total other business receipts

......................................

151

(see instructions)

152 Total New York receipts

...............

152

(add lines 142, 144, 146, 148, and 150)

153 Total receipts everywhere

153

............

(add lines 143, 145, 147, 149, and 151)

Payroll

(see instructions)

156 New York wages and other compensation of employees, except

general executive officers ............................................................................ 156

157 Total wages and other compensation of employees, except general

executive officers .............................................................................

157

Combined business allocation percentage for trucking and railroad corporations

(see instructions)

161 New York revenue miles .......................................................................

161

162 Total revenue miles ..............................................................................

162

436005140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10