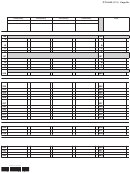

Form Ct-3-A/b - Subsidiary Detail Spreadsheet - Attachment To Form Ct-3-A - General Business Corporation Combined Franchise Tax Return - 2014 Page 9

ADVERTISEMENT

Page 5a CT-3-A/B (2014)

Legal name of the parent of the combined group

EIN

Subsidiary

Subsidiary

EIN

EIN

Legal name of corporation

Legal name of corporation

Combined investment capital

(see instructions)

196 Section 1 - Corporate and governmental debt instruments

196

(see instr.)

A Average value ......................................................................................

A

B Liabilities directly or indirectly attributable to investment capital ........

B

C Net average value

........................................

C

(subtract line B from line A)

D Net average value allocated to New York State ...................................

D

197 Section 2 - Corporate stock, stock rights, stock warrants, and stock

options

.....................................................................

197

(see instructions)

A Average value .......................................................................................

A

B Liabilities directly or indirectly attributable to investment capital ........

B

C Net average value

........................................

C

(subtract line B from line A)

D Net average value allocated to New York State ...................................

D

200 Cash (optional)

............................................................

200

(see instructions)

Combined investment income for allocation

(see instructions)

202 Interest income from investment capital listed on line 196, Section 1

202

..................................................................................

(see instructions)

203 Interest income from bank accounts

..........................

203

(see instructions)

204 All other interest income from investment capital

.......

204

(see instructions)

205 Dividend income from investment capital

205

...................

(see instructions)

206 Net capital gain or loss from investment capital

.........

206

(see instructions)

207 Investment income other than interest, dividends, capital gains, or

207

capital losses

...........................................................

(see instructions)

208 Total investment income

208

......

(add lines 202 through 207; see instructions)

209 Interest deductions directly attributable to investment capital

209

(see instr.)

210 Noninterest deductions directly attributable to investment capital

210

(see instr.)

211 Interest deductions indirectly attributable to investment capital

211

(see instr.)

212 Noninterest deductions indirectly attributable to investment capital

212

(see instr.)

Income from combined subsidiary capital

(see instructions)

216 Interest from combined subsidiary capital

216

..........................

(attach list)

217 Dividends from combined subsidiary capital

......................

217

(attach list)

218 Capital gains from combined subsidiary capital

.................

218

(attach list)

Combined subsidiary capital base

(see instructions)

Include all corporations (except a DISC) in which you own more than

50% of the voting stock. Do not include the value of any subsidiaries included in the combined return.

220 Average value .......................................................................................

220

221 Liabilities directly or indirectly attributable to subsidiary capital .........

221

222 Net average value

..................................

222

(subtract line 221 from line 220)

223 Net average value allocated to New York State ...................................

223

436009140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10