Maryland Form 500cr - Business Income Tax Credits Instructions - 2014 Page 10

ADVERTISEMENT

2014

BUSINESS INCOME TAX

MARYLAND

FORM

CREDITS INSTRUCTIONS

500CR

For information concerning qualifications for the credit, contact:

project costs and eligible start-up costs must follow the additional

instructions following Part P–IV Summary.

Maryland Energy Administration

Note: For tax years beginning after December 31, 2010, a qualified

60 West St., Suite 300

Annapolis, MD 21401

business entity, which has been certified for the tax credit, may

410-260-7655

claim a prorated share of this credit, if: (1) the number of qualified

meainfo@energy.state.md.us

positions falls below 25, but does not fall below 10, and (2) the

qualified business entity has maintained at least 25 qualified

Note: A copy of the certification by the Maryland Energy

positions for at least five years.

Administration must be included.

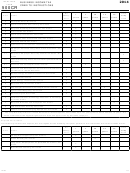

PART P-I - CALCULATION OF TAXABLE INCOME, WITHHOLD-

ING, QUALIFIED EMPLOYEES AND TAX LIABILITY

PART O - MARYLAND-MINED COAL TAX CREDIT

Note: Part P-I has two columns. Column 1 is used by all qualified

A credit is allowed for a qualified cogenerator, small power producer

business entities, except PTE members. Column 2 is used by PTE

or an electricity supplier (as defined under §1-101 of the Public

members only and should reflect a member’s distributive or pro

Utilities Article) for the purchase of Maryland-mined coal. An

rata share of the reported items, except lines 4a through 4d (see

electricity supplier may not have been a public utility before July 1,

the instructions below for Part P-I, Section A). PTEs complete

1999. A cogenerator or an electricity supplier must not be subject

only Sections A and C of Part P-I.

to the public service company franchise tax. The credit is $3 for

Read the Special Instructions-I For Qualified Entities That

each ton of Maryland-mined coal purchased in the current tax year.

Are Pass-Through Entities, following Part-IV Summary.

Specific Instructions

PTE members must read the Special Instructions-II For Members

Enter on line 1, Part O, the number of tons of Maryland-mined coal

Of Qualified Business Entities That Are Pass-Through Entities

purchased in the current year.

BEFORE completing Part P-I.

Multiply line 1 by $3 and enter the result on line 2, Part O, and

Section A This section is used to separate the qualified business

also on line 15, Part W.

entity’s Maryland taxable income from the project (the “project

taxable income”) from the Maryland taxable income not associated

The credit is limited to the amount of Maryland State income tax on

with the project (the “non-project taxable income”). Project taxable

the return. No carryover of excess credits exists for this tax credit.

income is the income generated by or arising out of the eligible

The amount of this credit must be certified by the State Department

economic development project.

of Assessments and Taxation.

For taxpayers that are not PTE members, enter your Maryland

For more information contact:

taxable net income from your return on line 1.

State Department of Assessments and Taxation

For PTE members of a qualified business entity, enter your Maryland

301 W. Preston Street

taxable net income from the PTE on line 1.

Baltimore, MD 21201-2395

On line 2, enter your share of the Maryland taxable income from the

410-767-1191

project (“project taxable income”) of the qualified business entity.

taxcredits@dat.state.md.us

To calculate the project taxable income, proceed as follows:

Note: A copy of the certification by the State Department of

Assessments and Taxation must be included.

1.

If the project is a totally separate facility, then project

income is figured by using separate accounting, reflecting

only the gross income, deductions, expenses, gains, and

PART P - ONE MARYLAND ECONOMIC DEVELOPMENT TAX

losses directly attributable to the facility and overhead

CREDIT

expenses apportioned to the facility.

General requirements Credits may be claimed for eligible project

2.

If the project is an expansion to a previously existing facility,

costs and for eligible start-up costs incurred to establish, relocate

then figure net income attributable to the entire facility by

or expand a business facility in a distressed Maryland county. To

using separate accounting reflecting only the gross income,

qualify for the credit for project costs, a minimum of $500,000

deductions, expenses, gains, and losses directly attributable

must be spent on eligible project costs. At least 25 newly hired

to the facility and overhead expenses apportioned to the

qualified employees must be employed for at least one year

facility and net income attributable to the project. Next,

at the new or expanded facility.

figure the project income by apportioning the entire facility

income to the project.

This credit may also be claimed by tax-exempt nonprofit

organizations that are qualified business entities against their

Or,

unrelated business taxable income.

3.

If separate accounting method is shown to be not

If claiming a credit for multiple projects, complete a separate Part

practicable, use an alternate method approved by the

P for each project.

Comptroller of Maryland or the Maryland Department of

Business and Economic Development (DBED).

For information on distressed counties, qualified employees, eligible

costs, and other requirements, businesses must satisfy to qualify

Enter the non-project Maryland taxable income on line 3. This

for credit, contact:

result is determined by subtracting line 2 from line 1. If less than

0, enter 0.

Maryland Department of Business and Economic Development

Enter on line 4a the number of qualified employees. This number

Office of Finance Programs, Tax Incentives Group

is not allocated or pro-rated; a PTE would report this same number

401 E. Pratt St.

on Maryland Form 510 Schedule K-1 to all PTE members.

Baltimore, MD 21202

410-767-6438 or 410-767-4980

A qualified employee is an employee filling a qualified position.

Generally, this is a position that is full-time and of indefinite

duration, is paid at least 150% of the federal minimum wage, is

Pass-through entities (PTEs), filing Maryland Form 510 with eligible

10

14-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16