Maryland Form 500cr - Business Income Tax Credits Instructions - 2014 Page 2

ADVERTISEMENT

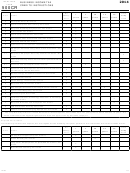

2014

BUSINESS INCOME TAX

MARYLAND

FORM

CREDITS INSTRUCTIONS

500CR

2.

Were employed at least 35 hours per week by the business

PART A-II - Credit for other qualified employees not located

in a focus area. A credit is allowed for each new qualified

for at least six months before or during the business entity’s

tax year for which a credit is claimed;

employee not located in a focus area not provided in Part A-I. The

credit is limited to $1,000 of wages paid and is applicable for only

3.

Spent at least one-half of their working hours in the

the first year the employee was qualified.

enterprise zone on activities of the business resulting

directly from its location in the enterprise zone;

On line 6, Part A-II, enter the number of first-year qualified

employees who are not located in a focus area who were not

4.

Earn 150% or more of the federal minimum wage; and

claimed in Part A-I.

5.

Were hired by the business after the later of the date on

On line 7, Part A-II, enter the amount of wages for these employees

which the enterprise zone was designated or the date on

up to a maximum of $1,000 per employee.

which the business entity located in the enterprise zone.

PART A-III - Credit for economically disadvantaged

In addition, an employee may not have been hired to replace an

employees located in a focus area. A credit is allowed for each

individual employed by the business in that or the three previous

new economically disadvantaged employee for a three-year period

tax years except an economically disadvantaged employee hired

beginning with the first year the employee was qualified.

to replace a previously qualified economically disadvantaged

employee, for whom the business received the corresponding

The credits are limited to the following amounts of wages paid

to the same economically disadvantaged employee: $4,500 in

first- or second-year credit in the immediately preceding tax year.

the first year, $3,000 in the second year and $1,500 in the third

For information on the location of enterprise zones and focus areas

year. If the employee replaced a previously qualified economically

and the standards which businesses must meet to qualify, contact:

disadvantaged employee, the credit for the new employee will be

Maryland Department of Business and Economic Development

the same as would have been allowed for the replaced employee.

Office of Finance Programs, Tax Incentives Group

On line 8, Part A-III, enter the number of economically

401 E. Pratt St.

disadvantaged qualified employees located in a focus area in their

Baltimore, MD 21202

first year of employment in the “First Year” box. Also, enter the

410-767-6438 or 410-767-4041

number of these qualified employees in their respective second

and third year boxes.

Economically disadvantaged employees are those who are certified

On line 9, Part A-III, enter the credit equal to the wages paid to

as such by:

each first year employee up to a maximum of $4,500 per employee.

Maryland Department of Labor, Licensing and Regulation

On line 10, Part A-III, enter the credit equal to the wages paid

Division of Workforce Development and Adult Learning

to each second year employee up to a maximum of $3,000 per

1100 N. Eutaw Street

employee.

Baltimore, MD 21201

410-767-2047

On line 11, Part A-III, enter the credit equal to the wages paid

to each third year employee up to a maximum of $1,500 per

That office will provide information relating to certification

employee.

requirements for such employees.

On line 12, Part A-III, enter the sum of lines 9 through 11.

Specific Requirements

PART A-IV - Credit for other qualified employees located in

Complete Parts A-I and A-II if the business is located in an

a focus area. A credit is allowed for each new qualified employee

enterprise zone but not in a focus area.

located in a focus area not provided in Part A-III. The credit is

Complete Parts A-III and A-IV if the business is located in a focus

limited to $1,500 of wages paid and is applicable for only the first

area.

year the employee was qualified.

PART A-I - Credit for economically disadvantaged employees

On line 13, Part A-IV, enter the number of first-year qualified

not located in a focus area. A credit is allowed for each new

employees located in a focus area who were not claimed in Part

economically disadvantaged employee for a three-year period

A-III.

beginning with the year the employee was qualified. The credits are

On line 14, Part A-IV, enter the amount of wages for these

limited to the following amounts of wages paid to the economically

employees up to a maximum of $1,500 per employee.

disadvantaged employee: $3,000 in the first year, $2,000 in the

second year and $1,000 in the third year. If the employee replaced

PART A - Summary

a previously qualified economically disadvantaged employee, the

Check the box if you are claiming a credit for a business located

credit for the new employee will be the same as would have been

in a RISE zone as defined in Section 5-1401(e) of the Economic

allowed for the replaced employee.

Development Article.

On line 1, Part A-I, enter the number of economically disadvantaged

Add lines 5, 7, 12 and 14 and enter total on line 15, Part A.

qualified employees not located in a focus area in their first year

Also the amount on line 15, Part A, becomes an addition

of employment in the “First Year” box. Also, enter the number

modification. Whenever an Enterprise Zone Tax Credit is claimed,

of these qualified employees in their respective second and third

an addition modification must be made in the amount of the credit

year boxes.

claimed.

On line 2, Part A-I, enter the credit equal to the wages paid to each

This credit is not refundable and is applied only against the

first year employee up to a maximum of $3,000 per employee.

Maryland State income tax. To the extent the credit is earned

On line 3, Part A-I, enter the credit equal to the wages paid to each

in any year and it exceeds the State income tax, the business is

second year employee up to a maximum of $2,000 per employee.

entitled to an excess carryover of the credit until it is used, or the

On line 4, Part A-I, enter the credit equal to the wages paid to each

expiration of five years, whichever comes first.

third year employee up to a maximum of $1,000 per employee.

Business must include certification with the return which shows

On line 5, Part A-I, enter the sum of lines 2 through 4.

the business is located in a Maryland enterprise zone.

2

14-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16