Maryland Form 500cr - Business Income Tax Credits Instructions - 2014 Page 3

ADVERTISEMENT

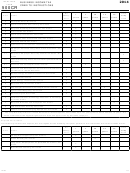

2014

BUSINESS INCOME TAX

MARYLAND

FORM

CREDITS INSTRUCTIONS

500CR

Maryland has more than 30 enterprise zones. Counties and

Line 2: Enter $5,000 for each qualified employee certified by the

municipalities are responsible for certifying a business as eligible

DHMH in their first year of employment.

for the tax credits. Contact the county or municipal enterprise

Line 3: Enter $5,000 for each qualified employee certified by the

zone administrator for more information. Department of Business

DHMH in their second year of employment.

and Economic Development (DBED) has a list of jurisdictions with

enterprise zones on its Web site. Go to

Line 4: Enter the sum of lines 2 and 3.

org to see the list of Maryland Enterprise Zones by Region.

Line 5: Enter the refund recapture amount, if applicable as a

positive number.

Line 6: Subtract line 5 from line 4 and enter the result on line 6

PART B – HEALTH ENTERPRISE ZONE HIRING TAX CREDIT

and on line 4, Part Y. If the result is less than 0, enter as

General Requirements A Health Enterprise Zone (HEZ) Employer

a negative amount.

may be eligible for tax credits based on wages paid to qualified

Note: A copy of the DHMH certification must be included with your

employees.

tax return when claiming this tax credit.

A “Health Enterprise Zone Employer” means a HEZ Practitioner,

No credit may be earned for any tax year beginning on or

a for-profit entity, or a nonprofit entity that employs qualified

after January 1, 2017.

employees and provides health care services in a HEZ.

A nonrefundable HEZ Practitioner Tax Credit is available on

A “Health Enterprise Zone Practitioner” is a health care practitioner

Maryland Form 502CR, Tax Credits for Individuals. Go to www.

who is licensed or certified under the Maryland Health Occupations

to download a copy of that form.

Article and who provides:

For more information about the HEZ Hiring Tax Credit certification,

•

Primary care, including obstetrics, gynecological services,

contact: DHMH.

pediatric services, or geriatric services;

•

Behavioral health services, including mental health or

alcohol and substance abuse services; or,

PART C - MARYLAND DISABILITY EMPLOYMENT TAX CREDIT

•

Dental services.

General Requirements Businesses that employ persons with

disabilities, as determined by the Division of Rehabilitation

A “qualified employee” is a HEZ Practitioner, community health

Services (DORS) in the Maryland State Department of Education

worker, or interpreter who:

and/or by the Maryland Department of Labor, Licensing and

(1) Provides direct support to a HEZ practitioner; and

Regulation (DLLR), may be eligible for tax credits for wages paid

(2) Expands access to services in a HEZ.

to, and for child care expenses and transportation expenses paid

on behalf of, qualified employees.

A qualified position is a full-time position of indefinite duration,

which pays at least 150% of the federal minimum wage, is located

Qualifying employees with a disability are those who are certified

in a HEZ, and is newly created as a result of the establishment or

as such by the DORS (or by the DLLR for a disabled veteran).

expansion of services in a HEZ and is filled. A qualified position

For certification or for additional information, contact:

does not include a position that is filled for a period of less than

Maryland State Department of Education

12 months.

Division of Rehabilitation Services

A HEZ Employer may claim a refundable credit of $10,000 for hiring

2301 Argonne Drive

a qualified employee in a qualified position in a HEZ, as certified

Baltimore, MD 21218

by the Department of Health and Mental Hygiene (DHMH).

1-888-554-0334 or 410-554-9442

To be eligible for the credit, the HEZ Employer may create one or

more qualified positions within a 24-month period. The $10,000

or,

credit must be taken over a 24-month period, with half of the credit

Maryland Department of Labor, Licensing and Regulation

amount allowed beginning with the first year certified.

1100 N. Eutaw St., Room 201

Baltimore, MD 21201

Recapture Provision If the qualified position is filled for a period

410-767-2047

of less than 24 months, the tax credit will be recaptured. The tax

credit will be reduced on a prorated basis, based on the period of

A “Qualified Employee” with a disability means an individual who:

time the position was filled.

1. Meets the definition of an individual with a disability as

defined by the Americans with Disability Act;

For information on the location of HEZs and the standards which

HEZ Employers must meet to qualify, contact:

2. Has a disability that presently constitutes an impediment

Maryland Department of Health and Mental Hygiene

to obtaining or maintaining employment or to transitioning

Health Systems & Infrastructure Administration

from school to work; and,

201 West Preston Street

3. Is ready for employment; or,

Baltimore, MD 21201

4. Is a veteran who has been discharged or released from active

410-767-5612

duty by the American Armed Forces for a service-connected

raquel.samson@maryland.gov or

disability.

dhmh.hez@maryland.gov

An employee must not have been hired to replace a laid-off

Specific Requirements

employee or to replace an employee who is on strike or for whom

Complete lines 1 through 6 in Part B of Form 500CR if the HEZ

the business simultaneously receives federal or state employment

Employer is located in a HEZ.

training benefits.

Line 1: Enter the amount of qualified employees certified by the

Qualifying child care expenses are those expenses incurred by

Department of Health and Mental Hygiene (DHMH) in the

a business to enable a qualified employee with a disability to be

appropriate box(es).

gainfully employed.

3

14-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16