Maryland Form 500cr - Business Income Tax Credits Instructions - 2014 Page 13

ADVERTISEMENT

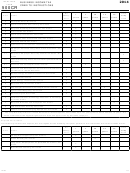

2014

BUSINESS INCOME TAX

MARYLAND

FORM

CREDITS INSTRUCTIONS

500CR

5.

If the number of employees is fewer than 25 employees, a PTE

To claim the credit, an individual or corporation must submit

must state whether or not the qualified business entity had 25

certification from the Maryland Department of Natural Resources,

filled qualified positions for at least five years from the time

which verifies the amount of oyster shells recycled during the year.

they have been eligible for the credit;

This credit is claimed on line 1, Part Q, and also is entered on line

6.

The tax year the project was put into service;

17, Part W, Business Tax Credit Summary.

No credit may be earned for any tax year beginning on or

7.

Amount of Maryland income tax required to be withheld from

these qualified employees;

after January 1, 2018.

8.

Total eligible project costs;

For additional information, contact:

9.

$5,000,000 maximum;

Maryland Department of Natural Resources

Tawes State Office Building

10. Total eligible start-up costs;

580 Taylor Avenue

11. $500,000 maximum.

Annapolis, MD 21401

410-260-8300

Therefore, a PTE must complete Sections A and C of Part P-I. The

distributive or pro rata portion of these items must be furnished to

each member of the PTE on the member’s respective Maryland Form

PART R - BIO-HEATING OIL TAX CREDIT

510 Schedule K-1. The PTE also must indicate on the Schedule K-1

An individual or corporation may claim a credit against the State

whether or not the PTE is a qualified business entity which would

income tax in an amount equal to 3¢ per gallon of bio-heating oil

be entitled to pass on a refundable credit or whether the credit

purchased for space or water heating. The credit may not exceed

is nonrefundable only. The PTE must provide a copy of the final

$500 per taxpayer.

certification to each member.

Any unused credit amount for the tax year may not be carried

SPECIAL INSTRUCTIONS-II FOR MEMBERS OF QUALIFIED

forward to any other tax year.

BUSINESS ENTITIES THAT ARE PASS-THROUGH ENTITIES

To claim the credit, an individual or corporation shall apply to the

Based on the Maryland Form 510 Schedule K-1, a member then

Maryland Energy Administration (MEA) for an initial credit certificate

may file the applicable Maryland income tax return, completing the

for the number of gallons of bio-heating oil purchased for space or

Form 500CR section of their electronic Maryland income tax return,

water heating. This credit is claimed on line 1, Part R, and also is

to claim the One Maryland Economic Development Tax Credit. The

entered on line 18, Part W, Business Income Tax Summary.

member should complete Part P of Form 500CR in its entirety to

No credit may be earned for any tax year beginning on or

compute the credit amounts and claim any of the credits allowed

for the tax year.

after January 1, 2018.

For the sections in Part P-I, the member would only complete

For additional information, contact:

Column 2.

Maryland Energy Administration

The PTE member (the member of the qualified business entity)

60 West St., Suite 300

must limit the amounts claimed for the project credit and start-up

Annapolis, MD 21401

credit to the distributive or pro rata portion of the PTE’s taxable

410-260-7655

income as reported on Maryland Form 510 Schedule K-1.

meainfo@energy.state.md.us

The PTE member computes the tax on the member’s share of

Note: A copy of the certification by the Maryland Energy

the PTE’s Maryland taxable income (line 1) using the highest rate

Administration must be included.

actually used on the member’s return and enter the result on line

6. The PTE member then will enter on line 7a that portion of line

PART S - CELLULOSIC ETHANOL TECHNOLOGY RESEARCH

6 which is attributable to the member’s share of project taxable

AND DEVELOPMENT TAX CREDIT

income. The tax on non-project income on line 8a is calculated by

taking the tax calculated on line 7a, prorating it further on line 7b,

An individual or corporation may claim a credit against the State

and then subtracting line 7a from line 6; if the amount on line 8a is

income tax in an amount equal to 10% of the qualified research and

less than 0, enter 0. Line 8a also is further prorated by the factor

development (R&D) expenses paid or incurred by the individual or

on line 4b, to arrive at line 8b.

corporation during the tax year. By September 15 of the calendar

year following the end of the tax year in which the expenses were

All amounts (except for line 13) entered in Section C of Part P-I,

paid or incurred, an individual or corporation may apply to the

should reflect the PTE member’s share of items as reported on the

Department of Business and Economic Development (DBED) for

Maryland Form 510 Schedule K-1.

the credit allowed. By December 15 of the same calendar year,

For Parts P-II, P-III, and P-IV, the PTE member should follow the

DBED will certify the amount of the tax credit approved. The total

preceding instructions for the respective parts.

amount of credits approved by DBED for any tax year may not

Note: The member must include a copy of the PTE’s final credit

exceed $250,000.

certification to claim the credit.

To claim the approved credit, an individual or corporation must

file an electronic amended income tax return for the tax year in

which the qualified R&D expenses were paid or incurred.

PART Q – OYSTER SHELL RECYCLING TAX CREDIT

The amount of the approved credit is entered onto line 1, Part S,

An individual or corporation may claim a credit against the State

and on line 19, Part W, Business Tax Credit Summary. Also, this

income tax in an amount equal to $1 for each bushel of oyster

amount is an addition modification on the tax return.

shells recycled during the tax year. The credit may not exceed

The individual or corporation must include a copy of the DBED

$750 per taxpayer.

certification of the approved credit amount to the amended

Any unused credit amount for the tax year may not be carried

income tax return. Any credit in excess of the State income tax

forward to any other tax year.

may be carried forward to succeeding tax years until the earlier of

the full amount of the excess is used, or the expiration of the 15th

13

14-49

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16